Crowdfund-based real estate opportunities in Canada

Crowdfunding Real Estate is becoming increasingly popular as it gives investors easy access to real estate investments to diversify their investment portfolios.

Fundscraper empowers everyday investors to add private market real estate investments to their portfolio. Access the institutional quality real estate investments usually reserved for institutions and high net worth individuals. Here, we compare key differences between the Fundscraper private real estate investment marketplace with typical crowdfunding platforms.

Why Fundscraper is the better alternative to Real Estate Crowdfunding in Canada

Crowdfunding platforms can vary extensively, depending on the product and the team behind it.

When choosing a platform, it’s important to recognize that the product is affected by the level of deal screening and the types of investment being offered.

Crowdfunding | Fundscraper | |

|---|---|---|

Regulatory Compliance | Most Canadian crowdfunding sites are not associated with a licensed Exempt Market Dealer (“EMD”). These sites typically raise capital by the sale of securities to the public through non-registered or online crowdfunding portals. They are not subject to regulatory requirements such as audits, operating capital and making timely reports to clients. | Fundscraper is an Exempt Market Dealer, a fully registered government regulated securities dealer specialized in real estate offerings and registered in Ontario, British Columbia, Alberta, Quebec, New Brunswick, and Prince Edward Island. As such, Fundscraper files regular reports to and is subject to periodic audits by government regulators such as provincial securities commissions. It meets government requirements for operating capital and must make timely and periodic reports to clients. |

Due Diligence | Most crowdfunding platforms have no requirement to undertake extensive due diligence on their offerings. The onus is on the investor to do their own extensive due diligence.

Furthermore, if they are not EMDs, they are not allowed to advise any investor or recommend on matters dealing with the merit, advisability, and suitability of their investment products. | All investment opportunities on the Fundscraper marketplace are pre-vetted by an experienced investment committee with over $5 billion in combined transaction experience.

As an EMD, Fundscraper is obligated to complete a Know Your Client and Know Your Product assessment for each investor. |

Returns | Crowdfunding issuers are not obligated to pay out their bottom line. | Fundscraper’s technology is designed to allow for competitive fees. Many of Fundscraper’s listed offerings such as Private MIC’s are obligated to pay out 100% of their profits and private REITs payout a minimum 90% of distributable income by regulatory requirements. |

Reporting | Generally no continued or minimal regulatory reporting responsibility under the crowdfunding portal and crowdfunding exemptions. | Extensive regulatory reporting obligations. |

Funding | Crowdfunding opportunities may fail to be fully funded and leave an investor disappointed. | Fundscraper through related entities invests its own funds or capital from its balance sheet to ensure the deals are fully funded regardless of the amount raised from independent investors. That way, projects can move forward as intended. |

Risk | Risk factors are not always outlined in detail in exempt crowdfunding portals. Investments tend to be more speculative and include all different industry sectors, asset classes and early stage concept based ideas. | Fundscraper provides a detailed list of risk factors, has a rigorous due diligence process on all its listings and endeavours to list investment offerings with management teams that have a proven track record. Investments thus tend to be less speculative, are backed by hard assets, and can have fixed income attributes. Fundscraper also ONLY focuses on private real estate offerings that have tangible security value. |

Role of the platform | Very few crowdfunding platforms serve the role of asset manager. | In many cases, Fundscraper, through its investment entities, serves as the asset manager through investor rights agreements with issuers, and serves to represent the interests of investors on specific projects. |

Registered Funds Eligibility | Not all crowdfunding platforms have offerings that are eligible for investing from your registered plan accounts (such as TFSAs and RRSPs). | Many of Fundscraper’s investment offerings allow you to invest from your TFSA, and RRSP plan accounts. |

Investment Minimums | Crowdfunding platforms tend to have very low investment minimums, usually starting from $100, in some cases even from as low as $1. | Fundscraper has offerings with investment minimums from $1,000 to $250,000 per investment order ranging from $25,000 to $20,000,000 total offering sizes per project raise. |

Why Fundscraper is the better alternative to Real Estate Crowdfunding in Canada

Crowdfunding platforms can vary extensively, depending on the product and the team behind it.

When choosing a platform, it’s important to recognize that the product is affected by the level of deal screening and the types of investment being offered.

Crowdfunding | Fundscraper |

|---|---|

Regulatory Compliance | |

Most Canadian crowdfunding sites are not associated with a licensed Exempt Market Dealer (“EMD”). These sites typically raise capital by the sale of securities to the public through non-registered or online crowdfunding portals. They are not subject to regulatory requirements such as audits, operating capital and making timely reports to clients. | Fundscraper is an Exempt Market Dealer, a fully registered government regulated securities dealer specialized in real estate offerings and registered in Ontario, British Columbia, Alberta, Quebec, New Brunswick, and Prince Edward Island. As such, Fundscraper files regular reports to and is subject to periodic audits by government regulators such as provincial securities commissions. It meets government requirements for operating capital and must make timely and periodic reports to clients. |

Due Diligence | |

Most crowdfunding platforms have no requirement to undertake extensive due diligence on their offerings. The onus is on the investor to do their own extensive due diligence.

Furthermore, if they are not EMDs, they are not allowed to advise any investor or recommend on matters dealing with the merit, advisability, and suitability of their investment products. | All investment opportunities on the Fundscraper marketplace are pre-vetted by an experienced investment committee with over $5 billion in combined transaction experience.

As an EMD, Fundscraper is obligated to complete a Know Your Client and Know Your Product assessment for each investor. |

Returns | |

Crowdfunding issuers are not obligated to pay out their bottom line. | Fundscraper’s technology is designed to allow for competitive fees. Many of Fundscraper’s listed offerings such as Private MIC’s are obligated to pay out 100% of their profits and private REITs payout a minimum 90% of distributable income by regulatory requirements. |

Reporting | |

Generally no continued or minimal regulatory reporting responsibility under the crowdfunding portal and crowdfunding exemptions. | Extensive regulatory reporting obligations. |

Funding | |

Crowdfunding opportunities may fail to be fully funded and leave an investor disappointed. | Fundscraper through related entities invests its own funds or capital from its balance sheet to ensure the deals are fully funded regardless of the amount raised from independent investors. That way, projects can move forward as intended. |

Risk | |

Risk factors are not always outlined in detail in exempt crowdfunding portals. Investments tend to be more speculative and include all different industry sectors, asset classes and early stage concept based ideas. | Fundscraper provides a detailed list of risk factors, has a rigorous due diligence process on all its listings and endeavours to list investment offerings with management teams that have a proven track record. Investments thus tend to be less speculative, are backed by hard assets, and can have fixed income attributes. Fundscraper also ONLY focuses on private real estate offerings that have tangible security value. |

Role of the platform | |

Very few crowdfunding platforms serve the role of asset manager. | In many cases, Fundscraper, through its investment entities, serves as the asset manager through investor rights agreements with issuers, and serves to represent the interests of investors on specific projects. |

Registered Funds Eligibility | |

Not all crowdfunding platforms have offerings that are eligible for investing from your registered plan accounts (such as TFSAs and RRSPs). | Many of Fundscraper’s investment offerings allow you to invest from your TFSA, and RRSP plan accounts. |

Investment Minimums | |

Crowdfunding platforms tend to have very low investment minimums, usually starting from $100, in some cases even from as low as $1. | Fundscraper has offerings with investment minimums from $1,000 to $250,000 per investment order ranging from $25,000 to $20,000,000 total offering sizes per project raise. |

Fundscraper’s Extensive Selection of Investment Products

Private Real Estate Investment Trust

Invest in a portfolio of (typically) income producing assets through units. Assets are already built and likely occupied with tenants to generate rental income and stable cash flows.

District REIT is our latest REIT offering.

District REIT

- Residential & Commercial

- Canada

*Historical performance does not guarantee future returns. Investing in real estate is risky and you should always seek professional advice including tax advice before investing.

Single Asset Mortgage Pool

Invest in a portfolio or single mortgages (secured by property that may or may not be income producing yet) through shares.

Greenery Street is our latest single asset mortgage pool offering.

Greenery Street Single Asset Mortgage Pool

- Residential mortgage

- Canada

*Historical performance does not guarantee future returns. Investing in real estate is risky and you should always seek professional advice including tax advice before investing.

Private Mortgage Investment Corporation (MIC)

Invest in a portfolio of mortgages (secured by property that may or may not be income producing yet) through shares.

NEST Capital MIC is our latest MIC offering.

NEST Capital MIC

- Residential mortages

- Canada

*Historical performance does not guarantee future returns. Investing in real estate is risky and you should always seek professional advice including tax advice before investing.

Private Equity

An investment through a purchase of units of a Limited Partnership vehicle; the typical structure is through a joint venture investment into a nominee company that holds title on behalf of the joint venture between the limited partners and the general partner (usually the sponsor or asset manager or development manager).

Harbour Club is our latest private equity offering.

The Harbour Club Port Dalhousie, Waterside Condo Development

- Development

- Canada

*Historical performance does not guarantee future returns. Investing in real estate is risky and you should always seek professional advice including tax advice before investing.

Our Track Record

Speaks For Us

10+%

$420 m+

7,500+

Getting started is easy.

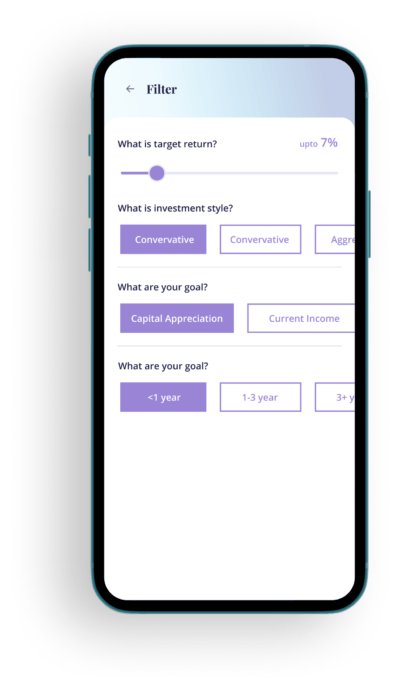

1. Sign up. Tell us what you’re looking for so we can help match you with opportunities that suit your investment needs and style.

2. Schedule a call. Our dealing representatives will help guide you through the process.

3. Invest through our fully digital platform. Track your progress and watch your money work for you.