District Property Trust

Opportunity to Earn Stable Monthly Income

Participate in a portfolio of stabilized, income-producing properties that generate a reliable monthly income stream in addition to potential net capital gains realized through rental increases, asset refurbishment and repositioning strategies.

11-13%

Projected Net Annual Return*

(Assumes 3-5 year minimum hold period)

6-8%

Current Cash Distribution Yield*

100%

Canadian Real Estate Focused

*Historical performance does not guarantee future returns. Investing in real estate is risky and you should always seek professional advice including tax advice before investing.

District REIT

Track Record

5

Years Track Record

$57.8

Million Invested

56,159

Commercial Rentable Square Feet

Invest in Real Estate with Confidence

District REIT is a real estate investment trust that owns and operates a portfolio of income producing properties; properties that would be very difficult for individual investors to acquire.

By purchasing Units in the REIT, investors are able to pool funds with other like-minded investors looking for part-ownership in a commercial portfolio. The REIT collects rent from the tenants, and net operating income of the real estate is distributed to the investors in the form of monthly distributions (cash flow!). Further, investors are expected to benefit from capital appreciation driven by increasing value of the underlying properties over time.

Minimum Investment

Simplified entrance into the REIT with minimum investment option of $10,000.

Distribution Reinvestment Plan

Earn an additional 2% Unit Bonus when you reinvest your distributions automatically with DRIP.

Registered Funds Eligible

Invest from RRSPs, RRIFs and TFSAs.

Portfolio Highlights

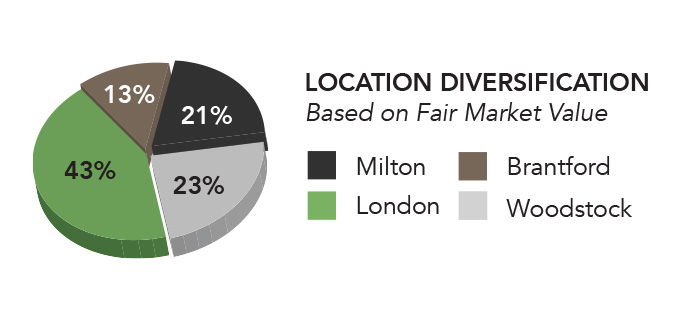

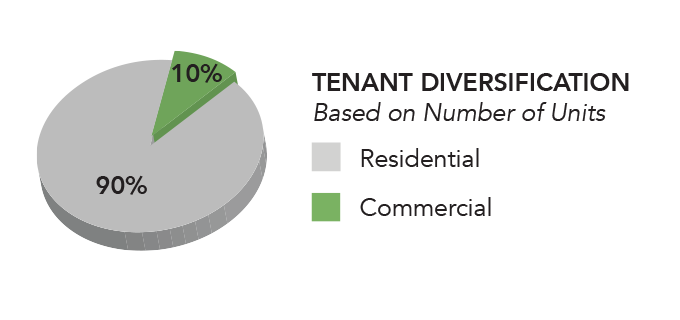

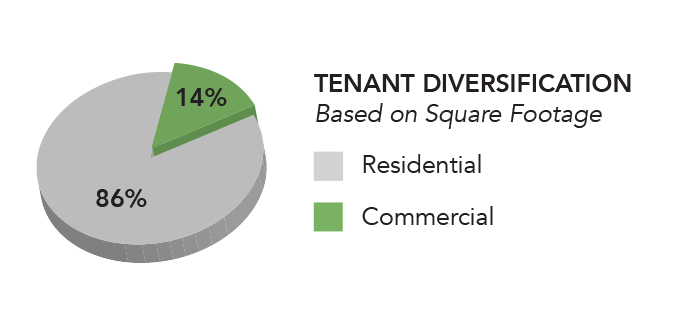

The management team has extensive operational experience with 50+ years of experience of real estate investing expertise. The District team has overseen the acquisition and management of more than $55 million in real estate with a specialization in real estate within the Golden Horseshoe area of Southern Ontario.

Portfolio highlights as of March 31st, 2022

ASSET DIVERSIFICATION

![Photo_[80-Bronte-Milton-ON]](https://www.fundscraper.com/wp-content/webpc-passthru.php?src=https://www.fundscraper.com/wp-content/uploads/2022/08/Photo_80-Bronte-Milton-ON.jpg&nocache=1)

![Photo_[110-Bronte-Milton-ON]](https://www.fundscraper.com/wp-content/webpc-passthru.php?src=https://www.fundscraper.com/wp-content/uploads/2022/08/Photo_110-Bronte-Milton-ON.jpg&nocache=1)

![Photo_[3410-South-Service-Rd-Burlington]](https://www.fundscraper.com/wp-content/webpc-passthru.php?src=https://www.fundscraper.com/wp-content/uploads/2022/08/Photo_3410-South-Service-Rd-Burlington.jpg&nocache=1)

![Photo_[3430-South-Service-Rd]](https://www.fundscraper.com/wp-content/webpc-passthru.php?src=https://www.fundscraper.com/wp-content/uploads/2022/08/Photo_3430-South-Service-Rd.jpg&nocache=1)

![Photo_[Riddell-Gardens-Woodstock-on]](https://www.fundscraper.com/wp-content/webpc-passthru.php?src=https://www.fundscraper.com/wp-content/uploads/2022/08/Photo_Riddell-Gardens-Woodstock-on.jpg&nocache=1)

![Photo_[Victoria-Westmount-Ctre-Kitchener-on]](https://www.fundscraper.com/wp-content/webpc-passthru.php?src=https://www.fundscraper.com/wp-content/uploads/2022/08/Photo_Victoria-Westmount-Ctre-Kitchener-on.jpg&nocache=1)

![Photo_[Wonderland-Path-London-ON]](https://www.fundscraper.com/wp-content/webpc-passthru.php?src=https://www.fundscraper.com/wp-content/uploads/2022/08/Photo_Wonderland-Path-London-ON.jpg&nocache=1)

Getting started is easy.

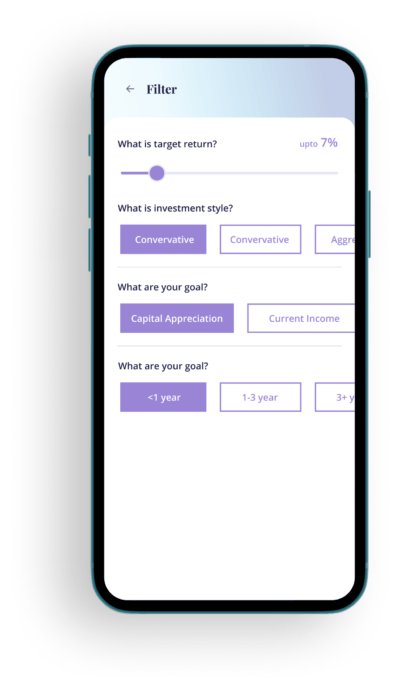

1. Sign up. Tell us what you’re looking for so we can help match you with opportunities that suit your investment needs and style.

2. Schedule a call. Our dealing representatives will help guide you through the process.

3. Invest through our fully digital platform. Track your progress and watch your money work for you.