Your Investor Eligibility Results:

Generally, securities offered to the public in Ontario must be issued with a prospectus, but there are exceptions. These exemptions are called prospectus exemptions. The offering memorandum (OM) prospectus exemption allows companies to sell securities to a wide range of investors based on an offering memorandum being made available to investors. An offering memorandum is a document that outlines a company’s business and affairs.

Anyone can buy securities under this exemption, but there are limits depending on whether an investor is an eligible or non-eligible investor.

Eligible Investor

In Canada, the details of the official definition of an eligible investor

and who qualifies as one can be found in section 1.1 of the National Instrument 45-106.

- Your net assets (or combined with your spouse) is greater than $400,000.

- You have before tax income of over $75,000 for at least two years in a row ($125,000 if you combine income with your spouse) and expect to exceed that income this calendar year.

Eligible investors can invest a maximum of $30,000, cumulatively, for all investments made subject to the OM Exemption in any twelve-month period unless they receive advice from a portfolio manager, investment dealer or exempt market dealer, in which case they can invest up to $100,000.

Ineligible Investor

If you do not meet the definitions of an eligible or accredited investor, you are considered an “ineligible” investor. However, this does not mean you cannot participate.

Non-eligible investors can invest a maximum of $10,000, cumulatively , for all investments made subject to the OM Exemption in any twelve-month period unless they receive advice from a portfolio manager, investment dealer or exempt market dealer, in which case they can invest up to $100,000.and who qualifies as one can be found in section 1.1 of the National Instrument 45-106.

Eligible Investor | Ineligible Investor | In Canada, the details of the official definition of an eligible investor

and who qualifies as one can be found in section 1.1 of the National Instrument 45-106.

There are more instances where you may qualify as an eligible investor. We invite you to complete create profile to complete our 5-min KYC questionnaire and speak to one of our licensed dealing representatives to determine your eligibility so you don’t miss out on any opportunities. | If you do not meet the definitions of an eligible or accredited investor, you are considered an “ineligible” investor. However, this does not mean you cannot participate.

Non-eligible investors can invest a maximum of $10,000, cumulatively , for all investments made subject to the OM Exemption in any twelve-month period unless they receive advice from a portfolio manager, investment dealer or exempt market dealer, in which case they can invest up to $100,000.and who qualifies as one can be found in section 1.1 of the National Instrument 45-106. There are more instances where you may qualify as an eligible investor. We invite you to complete create profile to complete our 5-min KYC questionnaire and speak to one of our licensed dealing representatives to determine your eligibility so you don’t miss out on any opportunities. |

|---|---|

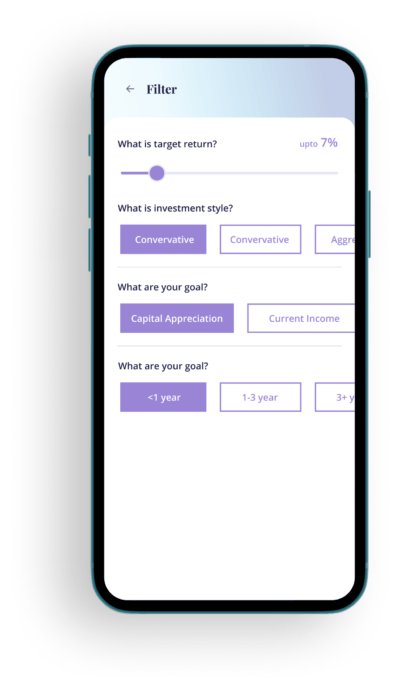

Investments that may match your investing style

NEST Capital MIC

- Residential

- Southern ON

Diversified First Mortgage Pool

- Residential

- ON

RESCO MIC

- Residential

- Western Canada

District REIT

- Residential & Commercial

- Canada

Avenue Living Real Estate Core Trust

- Multi-family Residential

- Western Canada

Centurion Apartment REIT

- Residential & Commercial

- Canada & U.S.

Discuss your results with a Fundscraper Expert

Your investor eligibility is a great starting point for talking to a financial professional.

Take 5 minutes to fill out our know-your-client questionnaire and a Fundscraper licensed Dealing Representative will reach out to you about your results and how to get started with real estate investing.

To learn more about the privacy of your information, visit our privacy policy.

Grow Your Portfolio

with Smart Real Estate Investing Today

Stay current on select offerings and new deals updated every month!