Retire Happy.

Build Your Wealth

with Real Estate Investing.

Reliable Passive Income

Enhanced Returns

Tax Advantages

Diversification

Retirement Savings Calculator — calculate savings required to reach retirement goal

This calculator easily answers the question "Given the value of my current investments how much do I need to save each month to reach my retirement goal?"

The user enters their "Current Age", there expected "Retirement Age", the "Annual Interest Rate (ROI)" (annualized Return on Investment one expects to earn) and "Amount Desired At Retirement".

The calculator quickly calculates the required monthly investment amount and creates an investment schedule plus a set of charts that will help the user see the relationship between the amount invested and the return on the investment. The schedule can be copied and pasted to Excel, if desired.

If you need a more advanced "Retirement Calculator" - one that calculates many more unknowns and one that calculates assuming retirement income and not a final lump sum then try the calculator located here: https:/financial-calculators.com/retirement-calculator

Currency and Date Conventions

All calculators will remember your choice. You may also change it at any time.

Clicking "Save changes" will cause the calculator to reload. Your edits will be lost.

Does real estate make a good retirement investment? It certainly can, and many people have secured a comfortable lifestyle by building a portfolio of real estate properties. Real estate can be a good investment if you educate yourself and go about it the right way.

Our free retirement calculator will help you understand how much you’ll need to save for retirement. Get started by telling us about your current financial picture.

How does our retirement savings calculator work?

Our retirement savings calculator gives you an idea of what your retirement savings strategy can look like. It helps answer, “How much do I need to save or invest each month to reach my retirement goal?” and creates a detailed schedule with projected date-based investments and charts.

What questions does the retirement calculator help answer?

Our retirement savings calculator can help you answer all the questions that make your head spin, like:

- How much do I need to retire in Canada?

- How much should I have saved for retirement?

- How much will I have when I retire?

- Am I saving enough for retirement?

- How much can I spend in retirement?

A word of warning

Our retirement savings calculator is not financial advice; it is for illustrative purposes only and the results are estimates. The calculator may be a useful tool in helping you estimate how much you need for retirement, but you should understand that it has limitations. For example, the calculator does not anticipate or take into account future changes to government retirement programs or tax rates. Also, rates of return on investments may vary.

Fundscraper Capital Inc. and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Offerings in our Marketplace Eligible for Registered Funds

NEST Capital MIC

- Residential

- Southern ON

RESCO MIC

- Residential

- Western Canada

Diversified First Mortgage Pool

- Residential

- ON

Centurion Apartment REIT

- Residential & Commercial

- Canada & U.S.

Avenue Living Real Estate Core Trust

- Multi-family Residential

- Western Canada

Equiton Residential Income Fund Trust

- Multi-family Residential

- Canada

Get a Free Guide to Registered Funds Eligible Offerings in Our Marketplace

Download our Product Comparison Chart for Real Estate Investment Trusts.

Helpful Resources

How Much Money Do I Need to Retire? Learn How Real Estate Can Help You Achieve Your Goals

Read More »

How to get retirement ready with real estate.

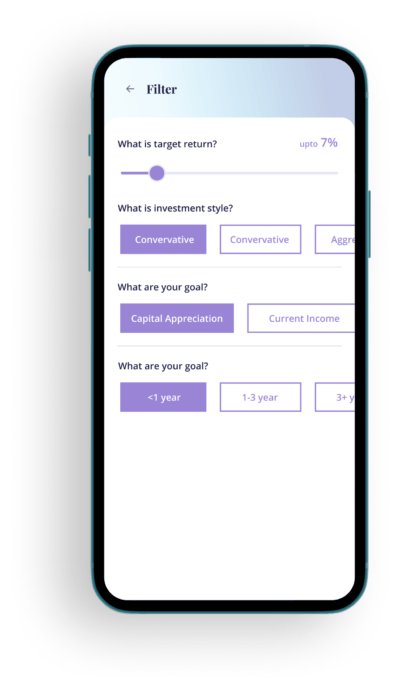

1. Sign up. Tell us what you’re looking for so we can help match you with opportunities that suit your investment needs and style.

2. Schedule a call. Our dealing representatives will help guide you through the process.

3. Invest through our fully digital platform. Track your progress and watch your money work for you.

Testimonials from Our Community

John D.

Former CTO, Toys R Us Canada

Michael C.

Retired, Former Head of Construction of a Publicly Traded REIT

Andre Kuzmicki

Adjunct Professor at the Brookfield Centre in Real Estate and Infrastructure, Schulich School of Business

FAQs

The minimum investment amount ranges from $5,000 through to $250,000. Each investment offering or project has its own investment minimums.

Each project varies in offering size. For the larger offerings, we work with the borrowers or project sponsors in determining the optimal minimum investment size.

Let’s build a better real estate portfolio together.

Luan Ha

CEO,

Dealing Representative

Terence Cheng

Vice-President, Operations,

Dealing Representative

Grow Your Portfolio

with Smart Real Estate Investing Today

Stay current on select offerings and new deals updated every month!