FUNDSCRAPER PROPERTY TRUST PRESENTS

Diversified First

Mortgage Pool

Now accepting Tax-Free Savings Accounts (TFSA)

Invest in Canadian residential first mortgages through the Fundscraper Property Trust, Diversified First Mortgage Pool to earn consistent monthly passive income while hedging against inflation and a volatile stock market.

Access to Canadian First Mortgages

Fundscraper’s Diversified First Mortgage Pool (‘DFMP’) enables Canadians to hedge their savings against rising inflation – secured by Canadian residential real estate.

Earn Premium Returns* relative to risk free fixed income investments such as GICs – the DFMP has successfully paid monthly

distributions with a target annual return of 7.25% since inception.

Fundscraper’s Diversified First Mortgage Pool aims to provide a conservative investment option to investors during these difficult economic times.

We only accept first mortgages to maximize principal protection, with a target cap on the average portfolio loan-to-value ratio of 70-75%.

In the unlikely event a borrower fails to repay a mortgage, we can enforce the mortgage, including a sale of the property to satisfy the debt. The risk of principal losses can occur if real estate values drop significantly, by more than 25-30% during the mortgage term.

Each individual mortgage within the pool is secured with residential properties primarily in established neighborhoods in southern Ontario.

Residential properties in established neighbourhoods are usually in higher demand by purchasers and thus easier to sell, mitigating holding risks by lenders when there are major negative changes in the economy.

Short mortgage terms, typically between 6 to 18 months, to reduce duration risk.

Adaptable: Mortgage within the portfolio typically mature within 6-18 months, reducing the duration risk and allowing renewals of existing mortgages or new mortgages to achieve higher interest rates as rates increase.

Hand-selected and carefully vetted leading to solid performance.

Solid Track Record: the DFMP has successfully funded and exited over 22 mortgages in the past year, with zero losses and outperformed the initial targeted return.

Carefully Vetted: the mortgages in the pool are hand selected by industry experts with over $5 billion of combined transaction experience.

Why Invest?

Premium, Stable Monthly Income*

Greater anticipated returns than traditional savings accounts and risk free investments.

Conservative Risk Profile

Greater Security*

Since inception: no principal losses, no months of distributions missed, and no known current defaults. All underlying mortgages are registered on title as first mortgages and secured by residential property.

Short Investment Term*

12 months investment term.

Tax-Free Income

Low Minimum Investment

Start investing in real estate with just $5,000.

Premium, Stable Monthly Income*

Greater anticipated returns than traditional savings accounts and risk free investments.

Conservative Risk Profile

Your investment is secured by residential real estate, hand-selected by our investment committee with over 125 years of real estate experience.

Greater Security*

Short Investment Term*

12 months investment term.

Tax-Free Income

Low Minimum Investment

*All returns are projected and illustrative only. Past performance is not indicative of future performance. Always review the offering documents and seek professional financial or tax advice before investing.

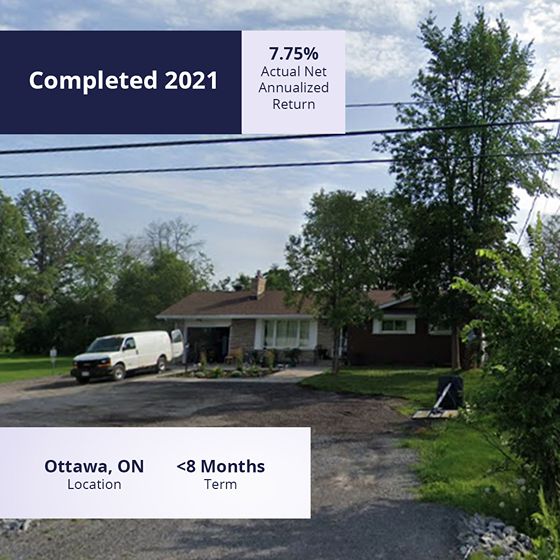

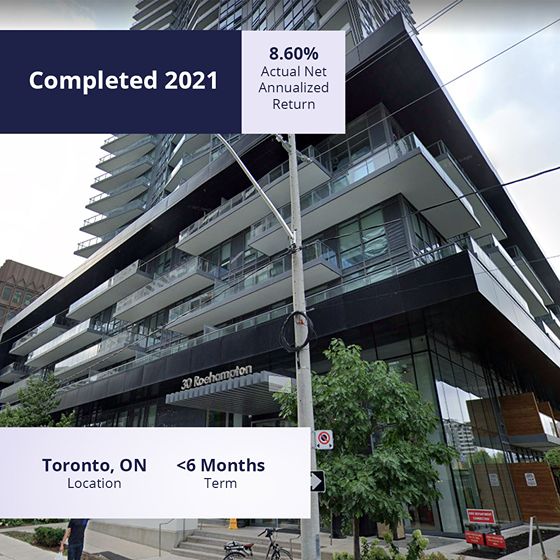

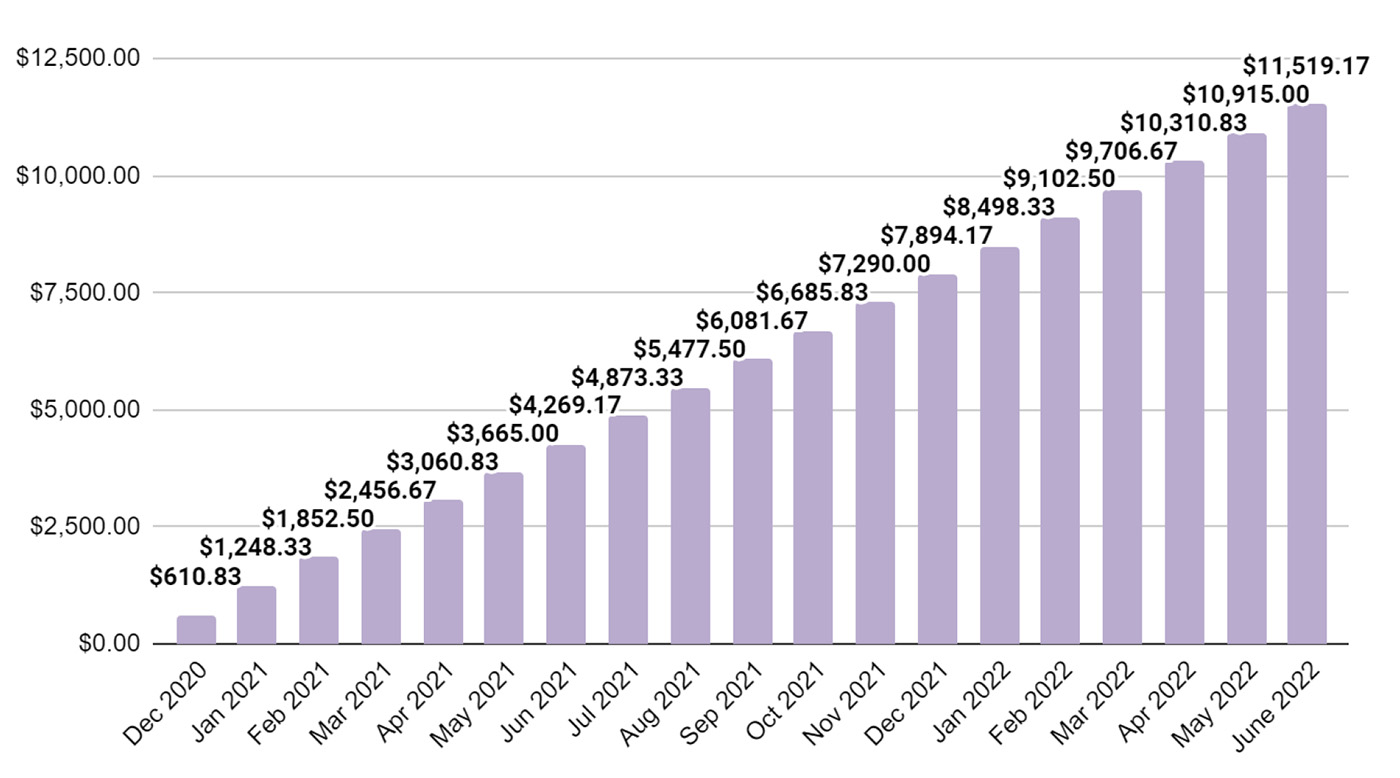

2021 Performance Track Record

Celebrating the success of all 22 completed mortgages in our Diversified FIrst Mortgage Pool.

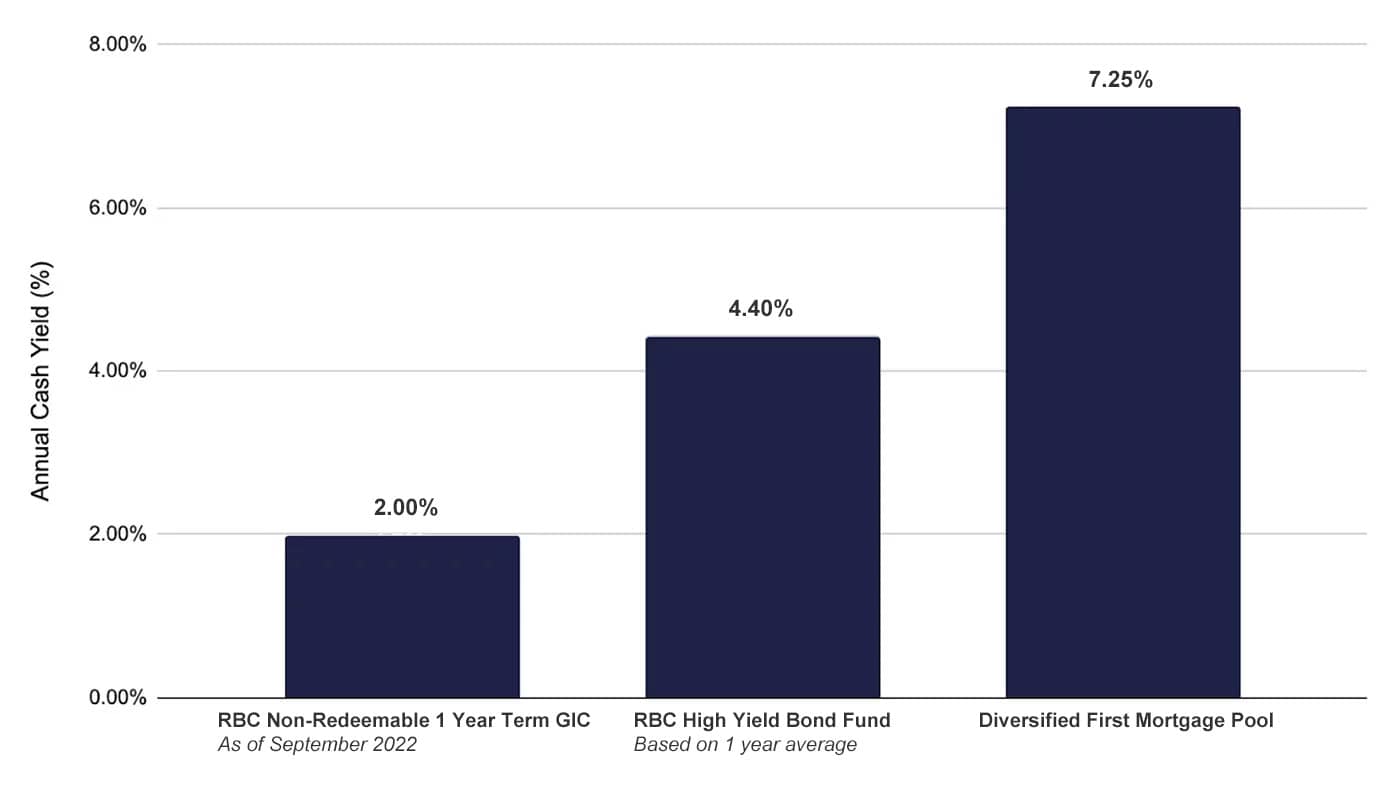

Where Else to Invest for Safety and Income

Fixed-income investments like GICs and bonds have been a popular investment option for generations.

After all, the idea of earning reliable, safe passive income is quite enticing.

However, yields aren’t what they used to be. And with inflation on the rise, fixed-income investments like GICs and bonds aren’t nearly as attractive for investors. So, how can you put your money to work and generate meaningful returns without taking on much risk?

A Comparison of Fixed Income Products vs. Private Real Estate Investments Cash Yields

Assuming you invested $100,000 on Nov. 1, 2020, you would have earned on a cumulative basis:

*All returns are projected and illustrative only. Past performance is not indicative of future performance. Always review the offering documents and seek professional financial or tax advice before investing.

Our Track Record

Speaks For Us

10+%

$470 m+

9,000+

Testimonials from Investors Like You

John D.

Board Advisor; Former CTO, Toys R US Canada

“Fundscraper provides access to investments that have traditionally been limited to only the few.”

Anton K.

AVP, Development Analytics, Riocan

“Fundscraper offers a great investment product for real estate investing!”

Michael C.

Retired, Former Head of Construction of a Publicly Traded REIT

“Thank you Fundscraper for delivering stable monthly distributions!”

Marta Z.

Associate Director, Global Investment Banking, Scotiabank

“The platform is great, the team is very knowledgeable, and the projects are well researched!”