Alternative To

Private Mortgage Lending

Private Mortgage Lending vs. Mortgage Investment Corporations

Private Mortgage Lending

Mortgage Investment Corporation

No Diversification

Private lending is lending funds on a single mortgage. This means the lender has to personally manage the mortgage and borrower payments. They will have to find a new investment once that mortgage has been paid out adding to the risk of downtime where cash is now earning a return. This can take weeks or even months and is often difficult to redeploy capital quickly. There is also a higher risk associated with this investment vehicle given higher levels of concentration in a single investment.

Diversification

File review, paperwork, collections, negotiating interest rates, etc. are all handled by professional management such as a Loan Administrator and Mortgage Brokerage, both licensed entities. MICs relieve the administrative and collection or loan enforcement duties from investors, as well as the stress that comes with it. MICs grow their portfolio over time so investors can benefit from a larger pool of mortgages and mitigate risks through diversification.

Administrative Burden

Private lenders review the file with their mortgage broker and lawyer and handle all payment receipts, collections and discharge statement preparations. Private lenders also have mortgagee duties and lack of performance may expose investors to lender liability.

Easy Administration

Once you have purchased shares in a MIC you can sit back and monitor the performance by professional management of the MIC. The MIC reports how your investment is performing and issues dividends on a periodic schedule. You don’t have to worry about Landlord duties, tenant disputes, rent or mortgage payment collection, and other administrative duties. The MIC handles all of this for you.

Lack Of Experience

Many investors lenders are not experienced or trained in loan enforcement and may let an unfit borrower use their money, not pay it back in a timely manner and this could result in higher risk and mismanagement of loan defaults.

Experienced Help

MICs have experienced managers in the mortgage administration and investment sector that will carefully review borrower worthiness, review properties and documentation, properly register and structure the mortgage investments, and help protect investor interests.

High Capital Requirements

Common lending amounts range from $50,000 to over $250,000 and generally needs to be funded by a single investor lender given recent changes to mortgage syndication rules. This inherently limits the ability for a single individual to diversify and seize on multiple opportunities at once.

Low Capital Requirements

Some MICs have investment minimums from $1,000 and provide exposure to a much larger pool of mortgages, giving investors the benefit of diversification across more mortgages.

Low Liquidity

Should you need your investment capital back, you have to wait for the borrower to pay you out, or refinance before the scheduled maturity, which can take time.

Higher Liquidity

A lot of MICs have minimum investment terms of 12 months, after which time requests for redemptions can occur, giving a liquidity opening for your investment capital.

Mortgage Investment Corporation Offerings In Our Marketplace

Access alternative private mortgage investment opportunities that have a track record of offering net annual returns from 7 – 10%*. Enjoy better diversification, lower risk, easier administration, experienced help, low captial requirements and higher liquidity compared to private mortgage lending. Fundscraper is Canada’s premier online private real estate marketplace aiming to help investors diversify their portfolio into pre-vetted real estate offerings.

*Historical performance does not guarantee future returns. Investing in real estate is risky and you should always seek professional advice including tax advice before investing.

NEST Capital MIC

- Residential mortages

- Canada

Royal Canadian MIC

- Residential mortgages

- Canada

CMI Balanced Mortgage Fund

- Residential mortgages

- Canada

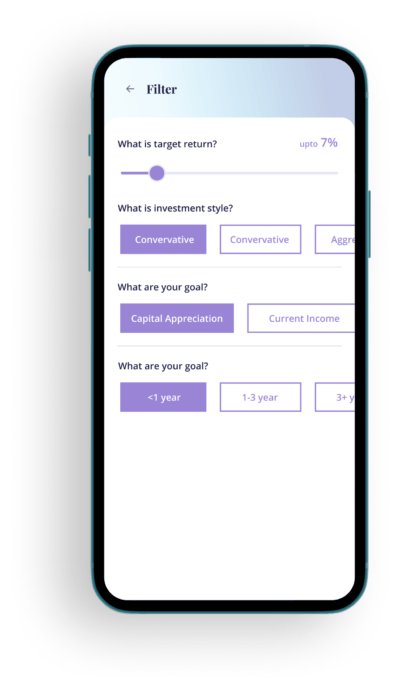

Getting started is easy.

1. Sign up. Tell us what you’re looking for so we can help match you with opportunities that suit your investment needs and style.

2. Schedule a call. Our dealing representatives will help guide you through the process.

3. Invest through our fully digital platform. Track your progress and watch your money work for you.

Testimonials from Investors Like You

John D.

Board Advisor; Former CTO, Toys R US Canada

“Fundscraper provides access to investments that have traditionally been limited to only the few.”

Anton K.

AVP, Development Analytics, Riocan

“Fundscraper offers a great investment product for real estate investing!”

Michael C.

Retired, Former Head of Construction of a Publicly Traded REIT

“Thank you Fundscraper for delivering stable monthly distributions!”

Marta Z.

Associate Director, Global Investment Banking, Scotiabank

“The platform is great, the team is very knowledgeable, and the projects are well researched!”