Table of Contents

- Introduction

- The traditional investment portfolio misses the mark

- The case for diversifying your investment portfolio

- Real estate as an essential part of your investments

- Invest like a big player — the 20% rule

- How to pursue real estate investing as an individual

- Summary

- The last word — make Fundscraper your ally

1. Introduction

Most of us might find it self evident that real estate investing is a good idea. After all, Mark Twain, the late famed American author, long ago advised us to “Buy land, they’re not making it anymore”.

Interestingly, the New York Times recently reported that the Mark Twain Historical Centre has mildly disputed the attribution of this often quoted advice to Twain. My guess is that it probably can be sourced to an over zealous real agent unwittingly dispensing sage counsel in order to boost their commissioned income!

Of course, there are naysayers who dispute the evident wisdom of real estate investing, at least by those among us who might be considered neophytes who don’t have much real estate investing experience.

So let’s have a closer look at why wealthy investors will consider including a good dose of real estate, whether by way of equity or mortgages, in their portfolios.

My goal is not so much to convince readers that real estate, in itself, is a good bet, but rather to make the case for diversification of their portfolios to include a meaningful segment of direct real estate holdings.

We will cover fundamental roles private real estate plays in a diversified investment portfolio:

- It is a hard permanent asset that can moderate risk and enhance your net worth through potential capital appreciation;

- It can provide fixed predictable returns through potential rental income of interest income;

- It will balance out unexpected wild fluctuations in public securities markets which in a worst case scenario could without notice crush the paper value of your public securities portfolio at any given time; and

- It is a source of additional benefits you won’t receive by only investing in stocks or bonds.

2. The traditional investment portfolio misses the mark

For the most part, financial professionals, wealth managers and often well-meaning friends recommend a pathway to balancing your investments — likely something along the lines of 60% in public stock market equities and 40% in public fixed income securities.

The idea is to mitigate risk through prudent asset allocation in various classes — stocks, fixed income (bonds) and cash.

Too often, the traditional portfolio mix fails to achieve optimum diversification because of the under-representation of alternative assets such as real estate backed investing.

3. The case for diversifying your investment portfolio

Our thesis is that overall you can better diversify by adding solid real estate secured investing, at the same time reducing your correlation to public markets volatility.

Most of us are naturally risk averse. Common sense tells us to spread our money out into a diversity of pots, hoping the ups and downs will balance out and we will enjoy a somewhat stable, if unspectacular, return on our investments.

Needless to say, the investment environment, especially in the stock and bond markets, can be volatile. There have been historically high and low returns in the last few years. Investing limited only to public markets always risks the chance of devastation if an “asset bubble” precipitously bursts. This can be brought on unexpectedly by major events beyond our control or ability to predict, for instance:

- world tensions and conflicts;

- environmental disasters;

- widespread technological advances or miscues;

- fluctuating interest rates;

- galloping inflation; and

- changing investment preferences of major institutional investors.

As to holding cash, trading in commodities or speculating in domestic and foreign currencies, all have short and long term risks, the nuances of which are generally only understood by a select group of expert investors and sophisticated professionals.

4. Real estate as an essential part of diversifying your investments

Real estate investing for the most part fluctuates quite distinctly from other conventional asset groups, like stocks and bonds. It has unique features. For instance, real estate is tangible and is what lawyers call an “immovable”.

By way of an aside and as a matter of general interest, in feudal times and for ages because few people could then read and write, the only recognized method of conveying land was by the gesture of actually handing over a piece of the dirt or the landscape to the new owner. This method of acquiring an interest in land, called “feoffment”, has long since been supplanted by conveyances founded in statutes — for example written and registered deeds and mortgages. Despite the obsolescence of the feoffment ritual, the notion of intrinsic permanent value of real estate remains embedded in our collective psyche. And so, a centuries old real estate investment strategy continues and thrives in today’s modern times.

Back to the discussion.

Unlike stocks and bonds real estate trades privately based on local factors such as:

- location (including comparable property values);

- supply;

- demand; and

- investment lifespan.

It is often scarce, particularly in growing areas, which translates to supply challenges and appreciating value. In your portfolio, real estate investing is a channel to investments backed by real hard assets that can provide a regular income stream and long term growth coupled with the benefits of diversification. Other benefits to note include:

- the ability to take advantage of leverage;

- tax deductions;

- a chance to create added value; and

- an increased voice or insight into the management of the asset.

There is no reason not to be able to enjoy superior diversification and potential performance at the same time.

Real estate investment for women, particularly, can practically be very important for their portfolios. On average, women simply live longer than men! The need to maintain and grow the value of a retirement portfolio is a pragmatic concern. Good real estate investing can only enhance the prospect of enjoying the benefits of things like reasonable leverage and the miracle of compound interest over an extended period of time, while protecting against the volatility and vagaries of other classes of investment and vice versa.

5. Invest like a big player — the 20% rule

Most of us never get a chance to participate directly in a major real estate project — usually grabbed up by big players, like private equity firms, banks, insurance companies, pension funds, and government institutions. We are mostly left to public mutual funds, real estate investment trusts (“REITs”), exchange traded funds (“ETFs”) and the like.

In fact these well-informed institutional investors typically employ a direct real estate investing strategy. Typical allocations can range from 9% to 15%(*) of their entire investment portfolio.

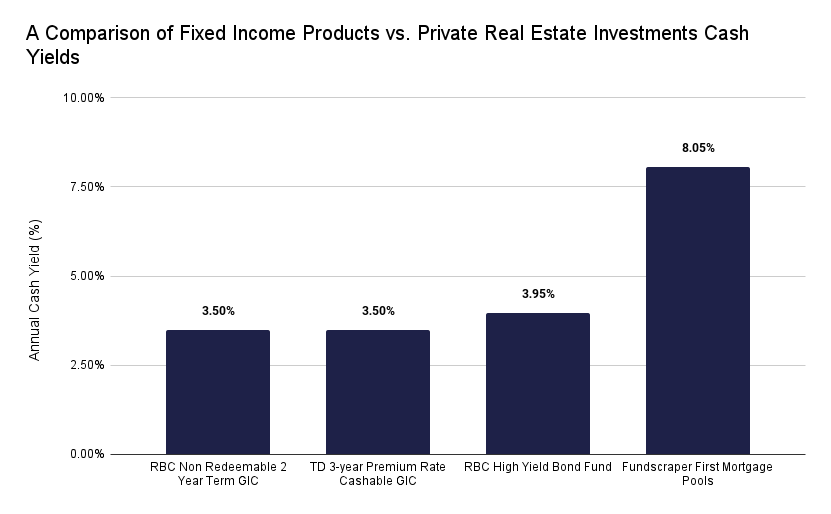

Benchmark returns with and without real estate make a compelling argument for the inclusion of real estate investing.

Sources:

- https://www.td.com/ca/en/personal-banking/personal-investing/products/gic/gic-rates-canada/

- https://www.rbcdirectinvesting.com/pricing/gic-bond-rates.html

- https://www.morningstar.ca/ca/report/fund/performance.aspx?t=0P0000Q34Y

In that regard, consider the experience of and the lessons to be learned from the Yale University Endowment, which is one of the best performing investment portfolios in North America, having a current value in the range of $30 billion. The fund is often known for its “20% rule” which at its peak allocated approximately 20% in private markets, including real estate.

Sources:

- https://www.investopedia.com

- https://www.origininvestments.com

- https://www.investments.yale.edu/about-the-yio

This invariably translates into potential premium risk adjusted returns over time for a real estate investor over one who employs a more traditional allocation based in public markets.

One can only conclude that it makes sense to piggyback onto a tried and true paradigm of real estate investing established by the major players.

6. How to pursue real estate investing as an individual

How can a smart, modern investor get in on the real estate investing action, especially since going on your own may require prohibitive amounts of capital?

Besides buying a home or taking on a private mortgage, there are any number of vehicles designed on a broad platform to facilitate an individual’s ability to put money into real estate — whether it’s equity or debt. You can in fact add real estate to your portfolio without actually buying property.

In Canada, we have mortgage investment corporations (commonly called “MICs”), mortgage trusts, limited partnerships, real estate mutual funds and the like. Generally these are all set up so that their investors share in any number of projects. This means returns are not necessarily fixed and depend on the performance of a pool of assets.

Yet, once you decide to add real estate investing to your portfolio, putting your plan into action brings with it a number of challenges — Where are the opportunities? Do they make sense? Is the asset mix right or over-concentrated? Is a direct investment better than a pooled one? etc., etc., etc.

This is precisely when you need a trusted party to step in and guide you in the right direction for real estate investing.

7. Summary

Meaningful real estate investing is essential to consider in developing a well-rounded and successful investment package.

Here’s a recap of why:

- Real estate is a hard permanent asset that can be securitized;

- Real estate backed investing can balance out the vagaries and unpredictable fluctuations in public securities markets, both domestic and international;

- Real estate can provide a regular fixed income stream over a set time frame; and

- Real estate investing, when managed well, can ideally pay off in the long term and at the same time maintain premium risk weighted returns that can combine benefits of capital appreciation and income.

8. The last word — make Fundscraper your ally

You may hear from a small minority of commentators that there are reasons to avoid direct real estate investing as part of your portfolio.

These basically distill down to the proposition that most people do not have the requisite knowledge or expertise. Individual challenges include assessing such things as:

- financial implications;

- neighborhood dynamics;

- data analysis;

- types of opportunities and comparable properties;

- property management skills;

- leverage;

- cash sufficiency; and

- physical inspections.

While many of these are valid reasons for an individual to be cautious, Fundscraper Capital provides the ultimate solution for your real estate investing knowledge. We will professionally handle the search, due diligence, and financial analysis to aid you to assess and make decisions with the salient data points at your fingertips and can assist with the completion of your investment in compliance with applicable laws and regulations.

Start Investing in Real Estate Backed Investments Today

Explore the investments available on Fundscraper.