When presented with long documents, it’s tempting to skim them, sign them, and hope for the best. But not so fast! Take the time to do your due diligence now to ensure you’re making smart decisions for your financial future. Our team broke down the basics of what every investor should know about that ever-intimidating document: the offering memorandum.

Key Points

- What Is an Offering Memorandum?

- Why Does an Offering Memorandum Matter?

- What Is Due Diligence?

- What Documents Can Supplement Due Diligence?

- 3 Important Things to Remember When Reviewing the Offering Memorandum

- 5 Important Questions to Ask When Reviewing the Offering Memorandum

- What Are the Typical Components of a Prescribed Offering Memorandum?

- How Do I Get Started?

If a company wants to raise money from investors, it will generally provide them with information about the venture. How the information is relayed to investors is governed by our rules regulating the securities industry. The rules vary per jurisdiction, but in general, securities regulators want to ensure that prospective investors know enough about the business to make an informed decision. This is a concept called “disclosure.”

One of the ways privately-held firms meet these disclosure requirements is to issue an offering memorandum (OM). There are two types of OMs: prescribed form and non-prescribed form. “Prescribed form” means the document must be prepared according to a guideline required by the regulators. This article breaks down the prescribed form of the OM.

What Is an Offering Memorandum?

An OM covers a substantial amount of legal and marketing material, including an executive summary, deal structure details, risks and disclosures sections, and an investor suitability form. It can be overwhelming to digest, but we’re here to break it down for you and highlight the crucial elements every investor should be aware of. You’ll likely find it useful not only for researching opportunities from Exempt Market Dealers (like Fundscraper!), but also private placement issuers, private equity and capital firms, and private mortgage funds.

In theory, OMs should provide investors with as much relevant information as possible. In practice, they’re complex documents written by lawyers for regulators.

Why Does an Offering Memorandum Matter?

Oftentimes, everyday investors don’t understand what an OM is or why they’re receiving it. They don’t have the experience or legal/financial/accounting training necessary to decipher 60+ pages of fine print—and that’s okay!

Since investors can only rely on an OM to make their decision, the reality is that many retail buyers do not know what they’re investing in unless they read the OM. They may grasp the general concept that they’re investing in real estate but be unaware of the minutiae that can alter the outcome of a deal. When they later discover unfavourable elements about the project, they often feel lied to and dismayed. Lack of awareness is one of the greatest risks associated with private investments.

At Fundscraper, part of our due diligence is making sure you understand yours.

What Is Due Diligence?

An investor cannot make a good decision without knowing all of the facts. We call this “doing your due diligence.” You may want to understand the following before deciding to purchase:

- Management fees

- Investors’ voting rights

- Indebtedness of the business

- How the investment will be repaid

- Conflicts of interest

All investors should know it’s impossible to disclose everything about an opportunity. A proscribed OM is designed by the regulators to deliver the minimum information the regulator believes a reasonable investor would require to make an informed investment decision.

With that in mind, use the OM as part of your due diligence before making an investment decision. You’ll want to investigate the industry, past performance, and the firm’s management team. Download the Fundscraper Due Diligence Checklist.

An Offering Memorandum is a crucial part of due diligence, but it’s just part of the equation.

What Documents Can Supplement Due Diligence?

The OM may refer to additional documents that prospective investors can receive upon request. For example, if the issuer is a trust (rather than a corporation or partnership), the OM might reference a declaration of trust or a trust indenture – documents that govern its mandate and management. You may want to understand exactly what the powers of the managers are and how the business must be run in far greater detail than what’s being disclosed. Investors should therefore scour through an OM for any mention of additional documentation.

For example, the OM may read, “ABC Trust will issue 1,000,000 trust units, pursuant to Section 4.1.3 of the Declaration of Trust.” While the declaration of trust is technically being disclosed, many investors will not realize that there is an entirely separate set of documentation that they should read before investing.

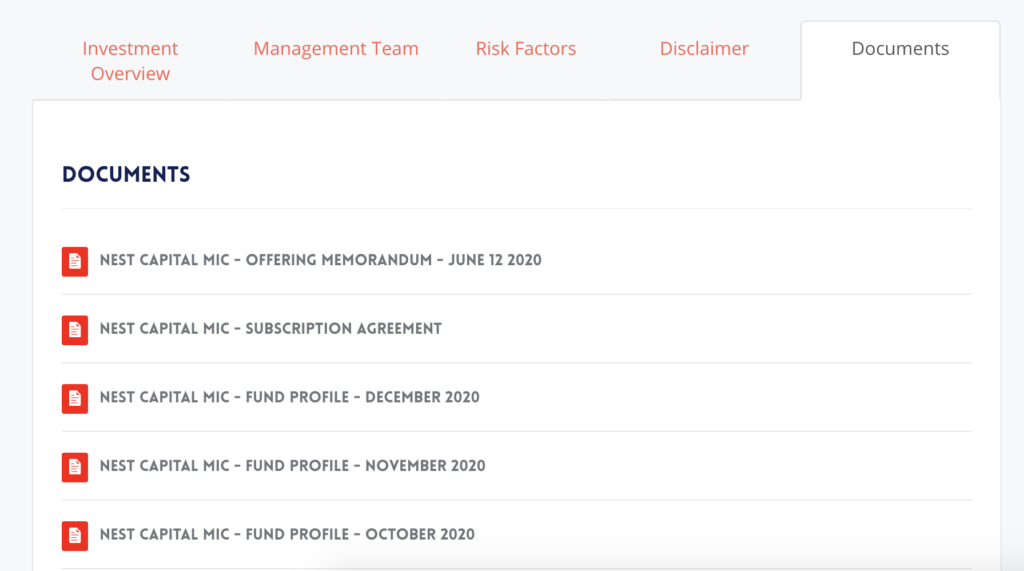

At Fundscraper, we aim to give you as much documentation, information, and transparency about properties in our marketplace as possible. The “Material Agreements” are available to you in the “Documents” tab of your account—see below.

3 Important Things to Remember When Reviewing the Offering Memorandum

- Regulators do not endorse investments.

While an OM may reference securities regulators and state that it has been filed with the authorities, that should not be construed as being endorsed by the regulator as a good investment. The Canadian Securities Administrators, the body representing the 13 provincial and territorial securities regulatory authorities across Canada, are not responsible for performing due diligence on behalf of investors with respect to OMs. Rather, it and its members exist to protect the integrity of the capital markets and to enforce the law. - Consider hiring independent counsel.

While an OM may contain dozens of pages written by lawyers, accountants, and auditors, those professionals are representing the issuer, not the individual investor. Thus, investors should hire their own advisors before deciding to invest. Do not allow yourself to feel a false sense of security by knowing that the investment was assembled by professionals. - Look for penalties, sanctions, and/or bankruptcies.

An OM should disclose whether any members of management have any legal or serious financial blemishes. Use that information to help form an opinion about whether your money would fall into reliable hands.

Never make assumptions about a prospective investment. It’s best to hire an independent counsel to review the OM and the terms of the deal with you.

5 Important Questions to Ask When Reviewing the Offering Memorandum

- How are the funds being used?

Never assume that all, or even most, of your money will be deployed into the targeted undertaking. The OM should disclose what, if any, fees will be paid to sales agents, how much will be advanced towards legal and administrative costs, whether there is any debt to service and how much will actually be deployed into the targeted undertaking. Moreover, investors should also understand what the continuing expenses of the venture will be over and above administration fees. These expenses can seriously dilute any available returns. - How is cash being distributed?

An investor should have a good understanding of how the fund receives income, how it intends to employ it, and how it will distribute any returns to investors. Once the underlying investments make returns to the fund, how much of those returns will be passed onto individual investors and how is that calculation determined? Do the managers earn a piece of the returns? Are there other parties that will share in those returns? Never assume that all or even most of the returns earned by the issuer will be passed onto investors. The flow of funds can turn a seemingly lucrative investment into a poor one. - How liquid is my investment?

Investments made via OM are less liquid than publicly traded securities on large stock markets. It is not uncommon for one’s capital to be locked up for a period of years in a given investment. Thus, an investor’s ability, or lack thereof, to sell the holding should be clearly disclosed in the OM. Note: Even in offerings where investors can easily redeem their shares, management usually reserves the right to reject redemption requests at their sole discretion. - How am I being taxed?

The tax implications of any investment are critically important for every investor to understand. What might be considered “tax advantageous” for one investor may be a disaster for another. (To complicate matters, investors and issuers are often taxed differently.) Where an issuer can provide a legitimate tax advantage to an investor, the investor must be fully aware of what the consequences might be if the issuer was to lose its unique tax status. Before investing, it’s important that the investor consult a professional about the tax consequences of the investment. - What are your rights?

As an investor, you can never assume that you have the ability to voice your opinions or influence management decisions. It’s important to search within the OM for your rights as an investor. For example, do you have the ability to vote, and if so, on what issues? How powerful is each individual vote? Can you attend annual general meetings? Are you able to request financial statements and other internal documents?

If you know what to look for and what questions to ask, you’ll be empowered to make smart investment decisions for your future.

What Are the Typical Components of a Prescribed Offering Memorandum?

The following are typical elements in a prescribed OM for a typical real estate investment in a hard asset like a building or development.

- Executive Summary: Lays out the high-level description of the investment company (which may control or be the acquiring entity), its mission, the deal being pitched, a detailed description of the executives’ industry experience, and the deal financing requirements.

- Location: If the OM is promoting a real estate opportunity, it will include the location of the asset. These images may include the property’s location on a map, an aerial view of the site, and a second map highlighting important places near the property such as an airport, public transportation, restaurants, and stores.

- Investment Summary: Covers various subtopics, each of which has its own separate section and brief description.

- Property Description: Describes where the property is located, when it was built, how large it is, any repairs it may need, and the current occupancy.

- Purchase Price: The price for which the property will be purchased and how the purchased price will be financed.

- Total Capitalization: Describes the “capital stack,” which shows the different layers in the financing of the project. Typically it would be first mortgage debt, next second mortgage, next preferred equity then finally equity. It’s really important to know where your investment dollars are in the “capital stack.” Traditional investment wisdom says the higher up you are, the safer your return.

- Preferred Return: An investor who earns a “preferred return” means they will get a return on their money before ordinary investors. A “preferred investor” generally comes after debt and before a common investor. Preferred investors will have different return expectations than ordinary investors.

- Projected Returns: Sometimes an OM will provide an indication of return. It is important for the investor to read the fine print wherever performance returns are disclosed. In a prescribed OM, certain kinds of “future-oriented financial information” must be prepared in accordance with strict guidelines. A licensed advisor can help an investor understand what is really behind an issuer’s projected return boast.

- Manager or Sponsor: The sponsor company that controls the investment entity. This entity is often referred to as the “promoter.”

- Property or Asset Manager: A description of the asset manager and their fees, which investors should review closely. They’re generally paid to the issuer, manager, and promoter before anything is paid to the investor.

- Proposed Structure: The structure of the deal between investors, sponsors, asset management, and property management. An old adage to understand a deal is “follow the money.” Learn who gets paid what, and when.

- Distributions: How surplus cash, i.e., the profits, are distributed to parties.

- Acquisition Fee: This can be anything: a flat sum paid on closing; a flat fee plus a continuing interest. Always ask why are these fees being paid this way and if it’s reasonable given the terms of the deal.

- Management Authority: How the manager holds control over the management and affairs of the property.

- Proposed Use of Proceeds: How your investment dollars are being used. This could include acquiring the property, making repairs, and maintaining the property.

- Estimated Sources and Uses: The amount of equity and debt to be raised, which then adds up to form the total sources of funds. Also included should be the uses of funds, including purchase price, closing costs, acquisition fee, working capital, and fronted capital expenditure.

- Loan Terms: Where applicable or relevant, the loan terms section is broken into the following subtopics:

- Loan amount: What is the approximate loan amount and the percentage of the purchase price it makes up?

- Borrower: Which entity will be borrowing and what kind of company it is?

- Interest rate: What is the locked interest rate?

- Term: How long is the term? Is it a fixed rate or variable rate?

- Amortization: Does amortization begin right away, or is there a period of interest-only servicing?

- Competitive Set: A table depicting the competitors in the issuer’s market.

- Industry Overview: Every industry is different, whether residential, retail, or another niche. This section describes what the specific industry for the property type is like in today’s market.

- Market Overview: Similar to the industry overview, the market overview gives geographic-specific insight into the real estate market where the building is located.

- Risk Factors: This section should include every risk related to the business, tax, accounting, and legality of the property. A typical OM includes 10-20+ risks and each one should have its own paragraph description.

- Investor Suitability: Real estate deals frequently receive support from accredited investors. This last section in the OM describes what types of investors the deal is suited for, and may be based on rules and regulations with regards to investor accreditation or general solicitation. These are the guidelines that concern the investors’ financial status and their ability to bear the risk of losing an investment.

How do I get started?

As you can see, an OM is a complicated document. Don’t just rush through it and assume the best! Take the time to do your due diligence before you invest your hard-earned nest egg.

It’s critical to have a licensed dealer assess whether the investor is first eligible to participate in the investment and then, secondly, whether the investment is a suitable investment for the investor. That’s where Fundscraper can help!

If you’d like to learn more about private real estate investment, visit www.fundscraper.com and sign up. Once you are part of our community, you’ll have access to the resources our members enjoy that help them explore real estate investment!

Start Investing in Real Estate Backed Investments Today

Explore the investments available on Fundscraper.