“Prospectus” and “Offering Memorandum” may sound like ancient Roman philosophers. But they’re actually documents that inform prospective investors about what’s being offered and on what terms. We put together an overview of what they include and how they function.

Key points:

- What Is a Prospectus?

- What Is an Offering Memorandum?

- How Is an Offering Memorandum Regulated?

- Eligible Investors vs Non-Eligible Investors

- How to Start Investing Today

There are two ways for an issuer to raise capital in Canada: publicly or privately. When done publicly, a prospectus is used; when done privately, a term sheet or offering memorandum is used. In both cases, the purpose of the document is for the issuer to inform a prospective investor about the security’s history and credentials, what’s being offered, and on what terms. These documents simply tell a story. Let’s take a closer look at what they include and how they function.

What Is a Prospectus?

If you elect to raise money from the public, you have to use a prospectus. A prospectus is a highly detailed document that is prepared by an issuer together with its lawyers and auditors under complicated rules that govern our public capital markets. A prospectus tells the story of the issuer and why buying the securities of the issuer is a good investment.

The document is first filed with the regulatory authorities who will actually review the preliminary drafts to ensure it complies with legislation requirements. The regulators do not assess the worthiness of the investment; they simply assess whether the document provides the disclosure required by law. This document is generally the only document an issuer can use to solicit the public. There are severe financial and criminal penalties if an issuer fails to use a prospectus to solicit the public or uses it improperly.

For a new issuer, a prospectus can be hundreds of pages and cost in excess of a million dollars taking into account such things as legal, auditing, and printing expenses. It is extremely expensive to raise money under a prospectus. The advantage, though, is that anyone can purchase securities that are qualified for distribution under a prospectus.

What Is an Offering Memorandum?

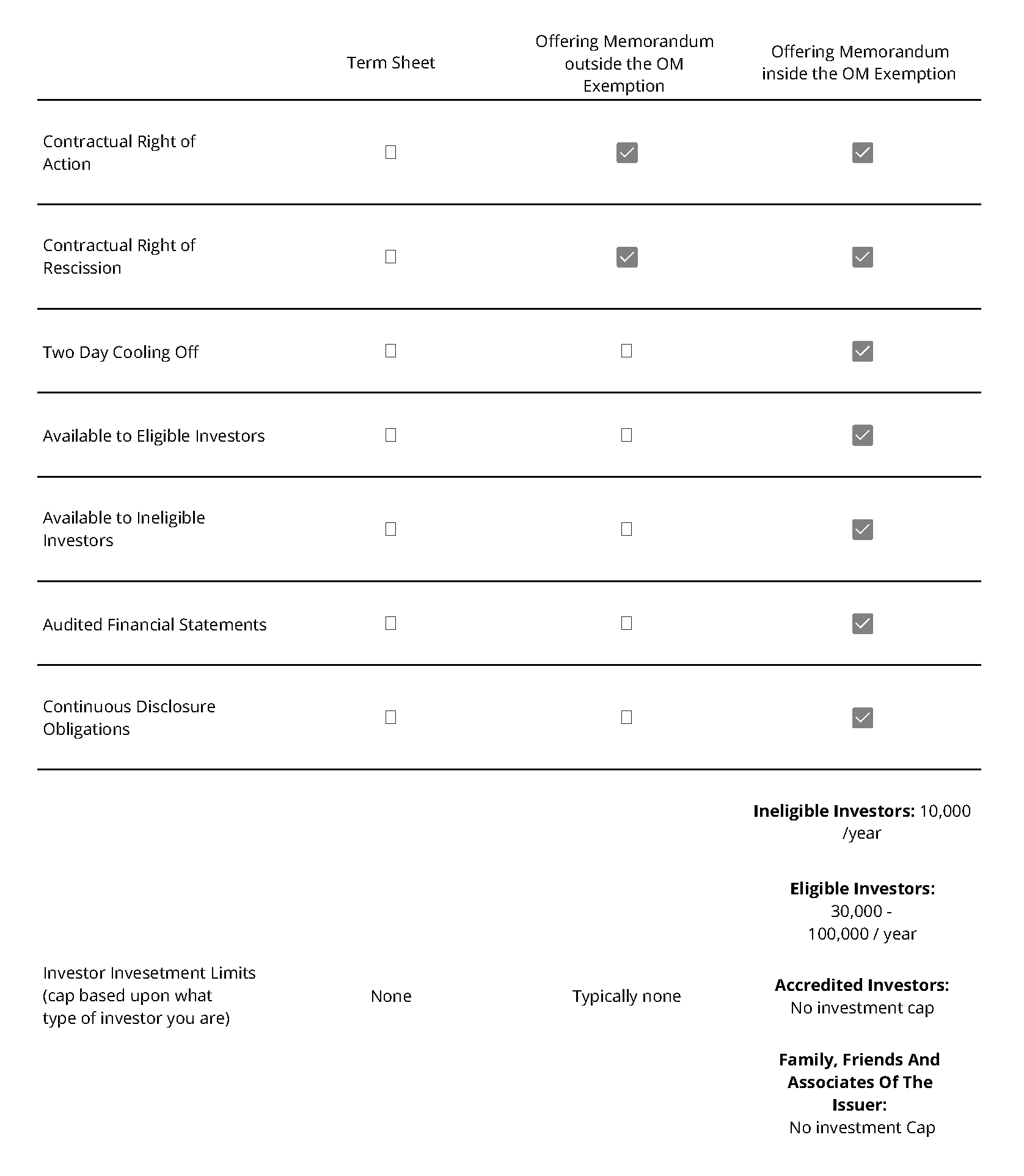

If you elect to raise money privately, you often use a term sheet or offering memorandum. Both documents function to inform a prospective investor about the specifics of the investment.

A term sheet is an abbreviated soliciting document that carries significantly less regulatory burden than an offering memorandum. It’s a bare-bones, skeletal overview of a securities offering with just a summary and the terms of purchase and sale. And we mean bare-bones: By regulation, a term sheet can have no more than three lines of text to describe the business of the issuer!

An offering memorandum is a more robust document. It describes, in detail, everything a prospective purchaser needs to know about a security being sold so they can make an informed investment decision, including:

How Is an Offering Memorandum Regulated?

Instead of mandating the contents of offering memorandums, regulators put the onus on issuers to ensure the information they put before investors is accurate. How do they enforce it? By giving them the right to sue an issuer or cancel their subscription in the issuer’s security if a misrepresentation is found in the offering documents.

Wherever an offering memorandum is used, the issuer must (except in very limited circumstances) provide potential purchasers with various contractual rights of action and rescission for any misrepresentation. The actual granting of the right will often be found in the subscription agreement (the agreement by which one purchases the relevant securities).

An offering memorandum is supposed to provide “prospectus-like disclosure.” This often results in many prospectuses being hundreds of pages long and nearly indecipherable. When the offering memorandum is not required to be in a prescribed form, the rule of thumb is to provide the information that an ordinary subscriber of exempt market security would expect upon which a reasonable decision can be made. At the heart of disclosure, it must not contain (i) a misrepresentation or (ii) an omission that would be tantamount to a misrepresentation.

An offering memorandum is supposed to provide prospectus-like disclosure.

What Is the Exempt Market and What Is an Exempt Market Dealer (EMD)?

Instead of raising money from the public, an issuer may raise money privately in the “exempt market.” This is the most common route issuers take. Raising money from the private capital market is also governed by extensive legislation. What makes it easier is that a prospectus is not required.

The exempt market describes a section of Canada’s capital markets where securities can be sold without the protections associated with a prospectus. Examples of activity in the exempt market include:

- Canadian and foreign companies, both public and private, selling securities to institutional investors and qualified investors

- Canadian and foreign hedge funds and pooled funds selling securities to institutional investors and qualified investors

Investors who buy securities through prospectus exemptions generally do not have the benefit of ongoing information about the security they are buying or the company selling it. They also often do not have the ability to easily resell the security. There is a presumption that given the wealth or expertise of the investor, or the quality of the security for which is being subscribed, the extensive protections provided by the prospectus requirements are not necessary.

An exempt market dealer (EMD) is a firm that has been licensed to distribute investment securities that haven’t been qualified by a prospectus, but are exempt from the prospectus requirement based on the rules and regulations of each province where the EMD is registered to carry on business.

Exempt market pro: The cost saving is tremendous.

Exempt market con: An issuer is only permitted to solicit certain groups of investors — ones the regulators believe do not need the disclosures and provided by a prospectus.

Eligible Investors vs Non-Eligible Investors

An eligible investor is an individual who makes $75,000 (or makes a combined $125,000 with a spouse) in each of the last two calendar years and expects to make the same in the current year. Alternatively, an eligible investor is an individual who has $400,000 of net assets.

An eligible investor can invest up to $30,000 in any one calendar year and, if a securities dealer has determined it’s suitable, up to $100,000 in any calendar year.

A “non-eligible” investor is a person who does not meet this minimum requirement. As such, they may only invest up to $10,000 in any calendar year.

How to Start Investing Today

Intrigued but still not sure where to start? Fundscraper can help. We’re an EMD registered to sell securities in the Provinces of Ontario, our Principal Jurisdiction, British Columbia, Alberta, Quebec, and Prince Edward Island. We recommend learning more about the Fundscraper Property Trust, a private investment vehicle that lets you invest in real estate with as little as $5,000.

Fundscraper has employed the rules of the exempt market to facilitate investment in the private real estate market. Our offerings are unique to Canada – Fundscraper is the only online investment platform today where anybody can learn about, become qualified to invest in, and actually subscribe for in a secure and transparent environment private real estate investment opportunities that have been vetted for consideration. Join our community of investors today and start growing your nest egg.

Start Investing in Real Estate Backed Investments Today

Explore the investments available on Fundscraper.