Investing in real estate is one of the smartest moves you can make, no matter what age or stage of life you are in.

Real estate investments can add diversification to your portfolio – and getting into the market can be as easy as buying a mutual fund.

If you’ve ever had a landlord, you probably don’t dream of being one: Fielding calls about oversize bugs and overflowing toilets doesn’t seem like the most glamorous job.

But done right, real estate investing can be lucrative, if not flashy. It can help diversify your existing investment portfolio and be an additional income stream. And many of the best real estate investments don’t require showing up at a tenant’s every beck and call.

In this article, we take a look at how real estate investments on our marketplace earn money.

Key Points

- Real estate investments break down into two broad categories: debt and equity.

- The main ways to make money are from asset appreciation and dividends from rents/interest payments.

- There are several ways to invest in real estate equity investments, including direct investment, mutual funds, REITs, and investment platforms.

Debt vs. Equity

Real estate investments break down into two broad categories: debt and equity. Let’s first look at the differences between these two types of investments to begin to understand how returns are structured in the form of income or appreciation.

| Debt | Equity |

Under a real estate loan, an investor lends money to a borrower (typically a buyer or real estate developer). The investor earns income for the duration of the loan usually at a fixed rate following a schedule of regular interest payments on the loan principal. A debt investment is typically less risky than an equity investment, but there are several factors that impact how risky each individual investment can be, as discussed below. | An equity investment gives an investor ownership of a physical property. An equity investment entitles the investor to a claim on money earned from any appreciation earned by the asset when it’s sold. Appreciation returns are usually realized in a one-time payment, in the form of capital gains. An equity investment also gives an investor the ability to earn regular income from rental payments for the lifetime of the investment typically on a monthly basis. While equity investments enable investors to earn both income and appreciation, they’re often riskier than debt investments as we discuss below. |

The main ways to make money are from asset appreciation and dividends from rents/interest payments.

How Real Estate Investments Earn Income

Is your primary investment objective Current Income? Both debt and equity investments can earn you consistent income. Let’s take a look at how.

Loan Interest Payments

A real estate loan investment is an arrangement in which an investor lends money to a buyer or developer who then pays interest on the principal lent. An investor earns a return in the form of income from the interest payment while the loan is repaid. Payments are often made on a monthly basis making them an appealing investment option for those seeking “passive” or “residual” income.

Debt investments can only earn income, but they offer the advantage of lower risk than equity investments do thanks to their senior position within the capital stack. This means debt investors receive their principal plus interest before an equity investor can realize any returns (apart from rental income potential).

Within the debt tranche of the capital stack, there’s a further division of seniority among the types of debt which determines loan repayment priority. Senior debt is unsurprisingly the most senior and therefore has the highest repayment priority. It’s followed by junior debt and mezzanine debt, and then the equity portion of the capital stack.

In addition to seniority, debt real estate investments can be secured or unsecured. An investor with a secured debt investment has the right to foreclose on a property in the event of loan default to recoup the value of their loan. Senior debt investments are typically secured positions, and other debt investments may be secured, but the terms can vary by investment.

Rental Payments

Equity investments can also generate their own income stream using rental payments. Traditional, or common, equity ownership gives investors the right to lease the property to tenants to earn income through rental payments.

Unlike a debt investment, which generally has a fixed rate of return over a defined lifetime, an equity investment generates rental income that can change over time, growing or shrinking in relation to market demand. Income potential is also based on occupancy rates, which can also vary for any given property. This means that equity investors may incur more risk to earn income, but they also have the potential to earn a higher rate of return.

Also, common equity investments don’t usually have pre-defined periods of ownership and can last indefinitely, giving an investor the ability to earn income until the property is sold. Real estate is a long-term investment, especially for equity investments, which gives investors the ability to earn significant income over time on a monthly basis.

Common equity ownership offers rental income potential, while preferred equity investments offer cash flow in a way that’s more similar to debt investments. Like a loan interest payment, preferred equity investments offer a fixed rate of return commonly referred to as “preferred return.” Due to its middle position in the capital stack, preferred equity investments receive payments until they’ve reached the agreed rate of preferred return after all debt investments have been repaid and before common equity investors receive their return.

How Real Estate Investments Earn Appreciation

There are several ways to invest in real estate equity investments, including direct investment, mutual funds, REITs, and investment platforms. The investment vehicle used to invest in an equity investment impacts how an investor receives their return as well as how and when it is taxed.

For example, an investor with a direct investment can collect their capital gains directly from the sale of an investment. On the other hand, an investor with an investment through a fund may realize appreciation from the sale of a property through a fund distribution or through an increase in the value of the shares that they own. Each option brings its own advantages and disadvantages, which can make each option more or less preferable for an investor, depending on their financial goals and resources.

Regardless of how you invest in real estate, at some point, a rigorous underwriting process, which evaluates the aspects of a potential investment property, is key. If you’re investing independently, the onus for that underwriting process will fall on your shoulders, whereas, if you’re investing through a fund or platform like Fundscraper, a team of experienced real estate professionals will handle the evaluation on your behalf.

No matter who performs the underwriting, this due diligence process plays a vital role in determining whether an investment opportunity is financially sound.

Evaluating Your Options

Common equity investments are easier to access than debt investments. Individual investors can buy an investment property and manage it on their own. However, due to the high sums of money, knowledge, and time commitment required for direct investment, individual investors are often limited in the number and types of properties that they can buy — and manage — on their own.

As with debt investments, pooled-fund investment options, such as mutual funds, REITs, and investment platforms, offer a way to invest small sums of money across several assets and asset types. Private equity funds are also available to accredited investors. While it’s more feasible for an individual investor to invest in a single-family home or duplex, a fund can give an investor access to investments across a wide range of commercial real estate in multiple locations at a fraction of the dollar investment size.

For instance, with Fundscraper, you can invest in opportunities with a target diversification level that matches your goals containing a mixture of assets across different geographies.

Fundscraper allows investors with small amounts of capital to get in on private real estate deals. Whether you are looking for cash flow now or let your money sit and grow over the long term, Fundscraper offers a wide range of opportunities including Real Estate Investment Trusts, Private Equity, Mortgage Investment Corporations and Mutual Fund Trusts with shorter and longer term horizons.

We welcome you to create a free profile and browse our marketplace. If you’d like to discuss your financial goals and your options with one of our licensed dealing representatives, fill out this short questionnaire and book your call today.

Start Investing in Real Estate Backed Investments Today

Explore the investments available on Fundscraper.

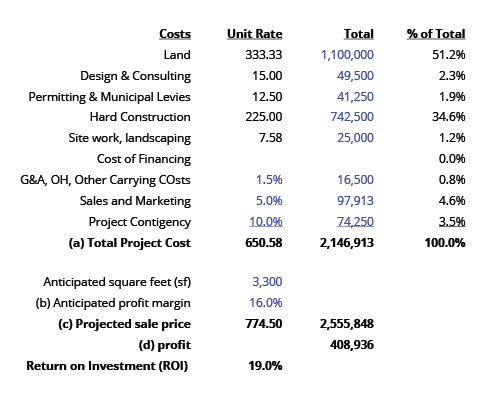

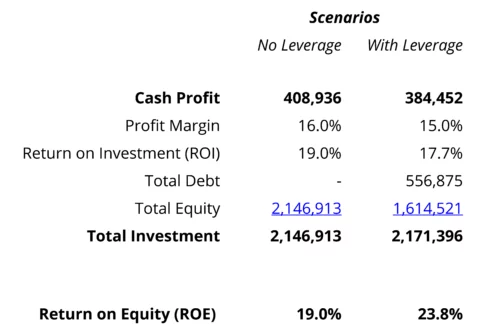

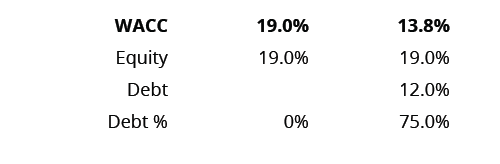

In the above No Leverage scenario, the developer maximizes the cash profit. However, they have to inject 2.146M of their own equity. For every dollar the developer invests, i.e. their equity injection, they will earn a 19% return or 19 cents for every dollar of equity. When a party invests for an ownership interest, then they have an equitable interest, or equity, and have a beneficial interest in the profits from the project. Put another way, an equity investor will likely expect or require a 19% return on their invested equity capital (the “expected return” or equity’s “cost of capital”).

In the above No Leverage scenario, the developer maximizes the cash profit. However, they have to inject 2.146M of their own equity. For every dollar the developer invests, i.e. their equity injection, they will earn a 19% return or 19 cents for every dollar of equity. When a party invests for an ownership interest, then they have an equitable interest, or equity, and have a beneficial interest in the profits from the project. Put another way, an equity investor will likely expect or require a 19% return on their invested equity capital (the “expected return” or equity’s “cost of capital”).

Your debt holders only demand 12%, but equity partners will want their 19% return. From a project point of view, the cost of that capital is going to be 19%! It’s the expected return your equity holders expect to receive by investing in the project. If you took on debt even at 12%, the math would work out to be 13.8%. So, overall, you can pay $0.138, or pay $0.19 for every dollar invested.

Your debt holders only demand 12%, but equity partners will want their 19% return. From a project point of view, the cost of that capital is going to be 19%! It’s the expected return your equity holders expect to receive by investing in the project. If you took on debt even at 12%, the math would work out to be 13.8%. So, overall, you can pay $0.138, or pay $0.19 for every dollar invested.