1) INTRODUCTION – THE SHOEMAKER’S CHILDREN SYNDROME

The old adage that “the cobbler’s children have no shoes” too often is so true for many Medical Professionals. They are typically so busy caring for others that they, like the proverbial shoemaker, neglect their own welfare.

This paper is intended to be a prescription for the financial well being of Medical Professionals at large — in particular Physicians, Dentists, Chiropractors and Pharmacists. You may be practising, retired or navigating on how to get there successfully — never too early or late to start!

We will cover why your investment strategy should consider including a healthy dose of private real estate backed investing as part of your investment portfolio mix. It’s all about the holy trinity of real estate investing:

- It is a hard permanent asset and can act as a hedge against inflation;

- It can provide a stable income stream;

- It can balance out volatility from wild fluctuations in the public securities markets.

2) SYMPTOMS

Medical Professionals all too well know the hazards of overwork, burnout, stress, depression, difficult patients and colleagues — on and on.

The last thing you need is needlessly to pile on the stress of financial planning and the challenges (and sometimes headaches) that go with it. The good news is that there are some simple tactics you can use to ensure your financial portfolio is adequately diversified.

Younger Medical Professionals are often starting behind the eight-ball (those who play billiards know that is not especially favourable!). Earning your credentials and licence to practise took several years of hard work and sacrifice, often resulting in sizable student loans and a late start to saving.

Some, but not all, more established Medical Professionals may already own homes and cottages, have management corporations and traditional investment portfolios, which may charge management fees regardless of performance and are subject to nerve wracking levels of volatility.

Yet, there is a good chance both the fresh faced and veteran Medical Professionals are too busy and undereducated in the fine tuning of finances to take the initiatives on their own that are so vital to financial wellbeing for them and their families.

The anecdotal record suggests that Medical Professionals are not always astute investors and often are the targets and victims of nefarious promoters and highly questionable schemes. Investopedia quotes Dr. Jim Dahle, a hockey playing emergency room doctor and blogger at the White Coat Investor, who says that the common reasons that most people struggle with money apply to doctors. These include “a lack of financial literacy, poor financial discipline and a lack of long-term perspective.” “In addition, there is a bit of a culture within academic medicine where you don’t talk about financial topics,” he says.

And so, if you are financially literate or not, read on to learn about a simple framework that anyone can adopt to achieve a more diversified investment portfolio which includes alternative assets and hopefully can generate a premium risk weighted return.

3) DIAGNOSIS — THE IMPERATIVE OF A PERSONAL WEALTH PLAN

Of course, we all need sufficient capital to support our desired lifestyles, now and in the future, and in many cases that of our loved ones. These are the so-called “necessaries of life”, the levels of which will be as varied as there are different Medical Professionals.

Someone said, “The best thing money can buy is financial freedom” — Easily said, not so easily accomplished. Financial security is not automatic. Its achievement necessitates careful planning and personal discipline.

Now that you have the benefit of a secure and steady flow of patients and customers with the prospect of solid earnings and some discretionary capital, what’s next?

Creating an investment portfolio that mimics your practice! A rich capital base that produces a steady flow of income with a future prospect of growth and surplus capital to spend! Real estate as an asset class mimics such attributes and can be a cornerstone of any such portfolio.”

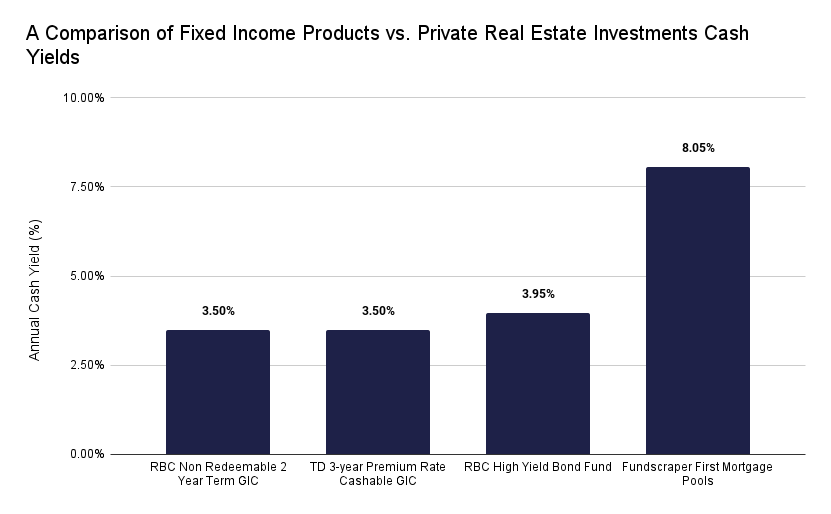

as of 2022-11-16

Sources:

https://www.td.com/ca/en/personal-banking/personal-investing/products/gic/gic-rates-canada/

https://www.rbcdirectinvesting.com/pricing/gic-bond-rates.html

https://www.morningstar.ca/ca/report/fund/performance.aspx?t=0P0000Q34Y

Coming up with a sensible plan designed, not only to maintain your lifestyle and wealth, but grow it for your future that includes the critical element of real estate, will take a large number of Medical Professionals into some unfamiliar territory.

Nevertheless, it is all important to your financial health to adopt a personal wealth blueprint to build your fortune and future.

This, no doubt, is the time to seek the wise counsel of your lawyer, accountant, and/or independent investment manager, but before you do so, let me give you some food for thought about why your wealth plan should consider adding real estate secured investments.

4) REAL ESTATE — A GOOD IDEA

Most of us find it axiomatic that real estate is a good idea.

After all, Mark Twain, the late famed American author, long ago advised us to “Buy land, they’re not making it anymore”. This was repeated in spirit by Louis Glickman, the famed real estate investor and philanthropist, when he said “The best investment on earth is earth.”

From the moment we stopped being nomads and “staked” claim to property, we began trading real estate. It began with lands used for agricultural purposes where the intrinsic value of the asset was realized (“Hey, we can stop wandering, grow food, get strong, and beat off the nomads!”), to housing, to commercial uses. A good idea does not die and real estate investment has been around almost as long as we have!

It’s not hard to appreciate why owning an income-producing building can potentially generate long term uncorrelated premium returns, often acting as a hedge against inflation since rental rates often correspondingly increase as incomes and inflation increase.

5) THE BETTER MOUSETRAP — BUILD A MORE PERFECT PORTFOLIO

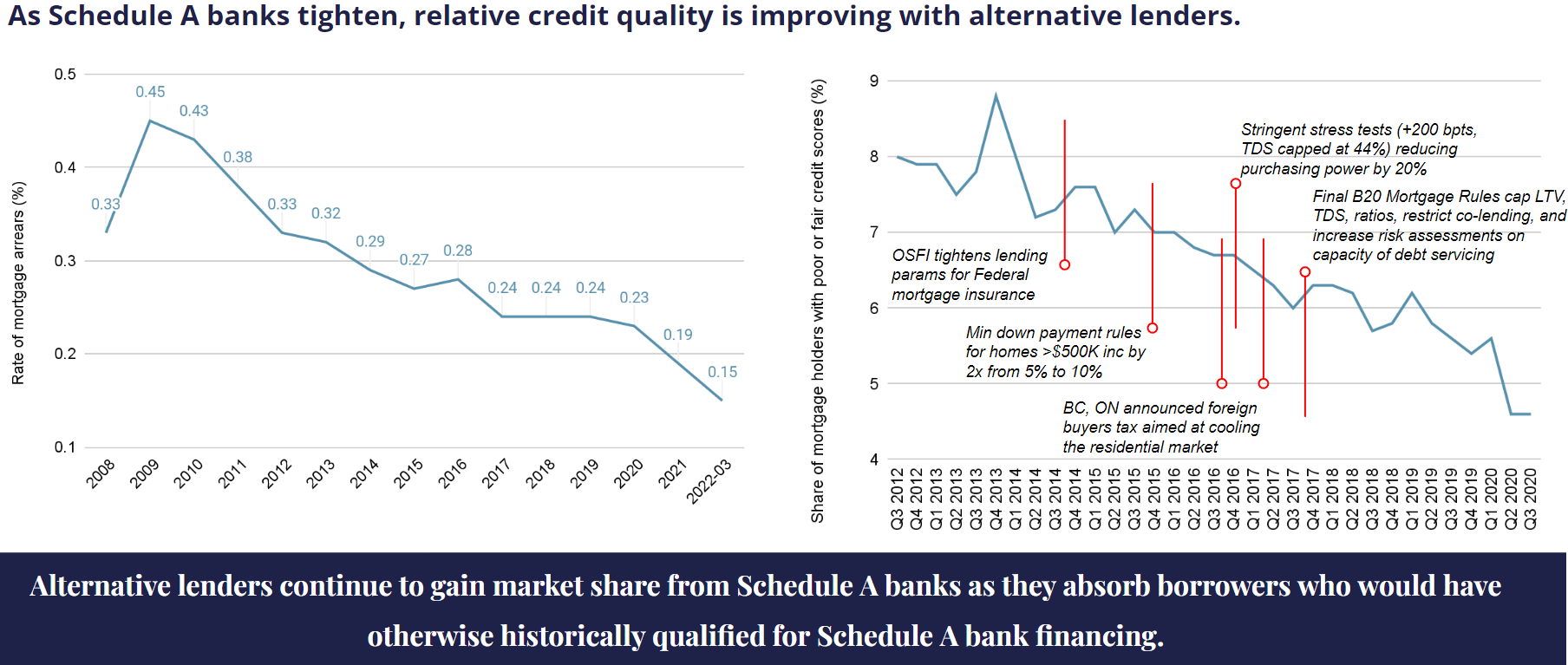

Sticking with investments in public stock market equities and fixed income securities is often unimaginative and open to vagaries of unexpected events beyond control that can subject your savings to volatile swings in value. In 2008 and more recently this year, this painful lesson was learned again by millions of investors around the globe. There is an investment bias that many amateur and seasoned investors possess: investing in stocks and bonds is all I have to do! These are only two asset classes. When assets are highly correlated within asset class as they are in both public stock and bonds, their prices tend to move in lockstep with one another, leaving those who hold them vulnerable to dramatic market swings. Without diversification outside these two public markets, investors can be in for a wild ride! This opens the case for diversification into private markets and alternative assets, like real estate.

Here’s how the wealthiest 1% invested, based upon data from one of the largest alternative asset managers, KKR Inc.:

Why not piggyback onto the tried and true paradigm of real estate investing strategies established by major players like endowment funds, pension funds, insurance companies, and high-net-worth and ultra-high-net-worth families.

Sources:

- https://www.investopedia.com

- https://www.origininvestments.com

- https://www.investments.yale.edu/about-the-yio

6) REAL ESTATE BACKED INVESTING AS AN ESSENTIAL AND UNIQUE INVESTMENT

We differentiate from vehicles like mortgage investment corporations (“MICs”), real estate investment trusts (“REITs”), mutual funds and the like, that pool any number of projects. By real estate secured investing we mean you select the individual projects one by one.

A decent level of real estate focused investing, whether in land or buildings, in your portfolio can mitigate volatile market swings.

I will tell you why.

Real estate, for the most part, fluctuates quite distinctly from other conventional asset groups, like stocks and bonds. It has unique features. For instance,

- Real estate is tangible and is what lawyers call an “immovable”. In other words, you can kick it.

- It is often scarce, particularly in growing areas and provides an opportunity for appreciation in value over time.

- Real estate is a hard asset with a potential income stream. It can allow for reasonable leverage and the miracle of compound interest.

7) THE PRESCRIPTION — THE DIAGNOSIS

“A simple fact that is hard to learn is that the time to save money is when you have some.” Joe Moore, American TV personality.

So called “best investors” like pension funds allocate 9 to 10%(*) of their entire investment package to real estate investing. Benchmark returns, with and without real estate, make a compelling argument for including real estate investing in your portfolio. See the previous sources for the Yale University Endowment Fund.

Meaningful real estate investing can be a prescription for a healthy, well-rounded and diversified investment package designed for today’s Medical Professionals.

Medical Professionals who invest wisely in real estate type securities for the long term can enjoy an excellent diagnosis for their financial health.

8) CALLING ALL MEDICAL PROFESSIONALS — MAKE FUNDSCRAPER YOUR ALLY.

You may hear from naysayers who dispute the prudence of real estate investing, at least by those among us who might be considered neophytes who don’t know any better. Their position basically distills down to the proposition that most people, including those whose main pursuit is in the medical arena, do not have the requisite knowledge, time, or expertise. While this is cause to be cautious, Fundscraper Capital provides a seamless online solution. We will professionally handle the search, due diligence and financial analyses to aid you to assess and make decisions with the relevant data points at your fingertips and then work with you to complete your investment in compliance with relevant laws and regulations.

Simply put, let Fundscraper help you diversify your portfolio with real estate backed investing by doing the heavy lifting.

If you are more comfortable, we are quite happy to liaise with any of your trusted advisors or investment managers. Please feel free to link them to this paper and invite them to connect with us to explore how we can collaborate on your behalf.

a. Background

It is important that you feel you are in trustworthy and capable hands and not have to worry about an unreliable sponsor or nefarious investment scheme. Governments everywhere are being proactive in enacting consumer protection legislation and strict regulations are the order of the day.

Fundscraper Capital Inc. is on the leading edge of online investing. It is an exempt market dealer registered with the Ontario Securities Commission in the Province of Ontario, and equivalent regulating authorities in other Canadian jurisdictions.

Further it is registered as a mortgage brokerage with and comes under the jurisdiction of the Financial Services Regulatory Authority of Ontario.

b. Online Platform and Technology

Fundscraper is an online platform that facilitates direct private investments by qualified investors into an array of real estate backed projects and investments sponsored by proven developers and owners. You select individual projects that interest you and invest directly, rather than through a conglomeration.

Fundscraper’s cutting edge technology uses best of practice compliance standards and introduces investors to real estate investing opportunities usually reserved for institutions or deep pocketed and well-heeled, connected investors. There is a high degree of comfort, not to be underestimated, in knowing exactly what you invest into, a unique experience you do not often get when investing in private markets.

c. More than a Platform

Fundscraper is far more than an online platform.

Our team is comprised of dedicated and experienced industry experts in all facets of Fundscraper’s business.

Transparency and trust are priorities. While we do not charge for or provide investment advice per se, we put forward the pros and cons of the real estate investing opportunities listed on our website, so you can make an informed decision on which to choose.

We take substantial steps to ensure that a given investment is suitable for you. We go to great lengths to observe the regulatory rules related to “Know Your Client” (KYC) and “Know Your Product” (KYP). We have a concierge service which makes a knowledgeable, registered representative available to assist you in things you need to know to take advantage of Fundscraper’s platform for real estate investing. Being part of the select “white lab coat body of Med Pros” will entitle you to “white gloves treatment” from Fundscraper.

d. Attractive Net Returns

Fundscraper opens up select investments to a large group of qualified individual Canadian investors as established by legislation, the general intent of which is, among other things, to make real estate investing more accessible to qualified investors.

As a generalized bare bones overview only, typically these qualified investors (including their spouses) fall into the following classifications.

- Accredited Investors — high net worth, of at least $1 million in net financial assets or $5 million in net assets, or sustained annual income of $200,000.

- Eligible Investors — with an offering memorandum, $400,000 in net assets or at least $75,000 of sustained annual income.

- Minimum Amount Investors — corporate investment of at least $150,000 in a single investment.

- Permitted Client — high net worth, of at least $5 million in net financial assets, ability to waive suitability.

The precise criteria for each of these categories as defined by applicable securities laws is somewhat complex and beyond the scope of this paper. Fundscraper is standing by to help you determine where you and/or your spouse fit in.

e. Conventional Wisdom

John Kenneth Galbraith, the late acclaimed Canadian born American economist is widely acknowledged to be the father of the phrase “conventional wisdom”.

It is that precise sense of conventional wisdom combined with old fashioned common sense that dictate that you consider diversifying your investment portfolio.

Fundscraper can make diversification into real estate happen for you. Keep in mind:

- We humanize digital investing with state of the art technology and open up private markets not usually available to a vast majority of investors.

- You will have a real concierge desk responsible to help you at every step in the real estate investing process.

- It isn’t hard to invest in real estate the Fundscraper way – we are primarily online and digital, but also can provide white glove services.

- We do a lot of the work to make sure you are able to make an informed decision on what the risks and rewards are when investing.

- Our highly experienced team underwrites and vets each deal based upon our collective management team’s experience of decades working with institutional investors.

- We have successfully processed some $500,000,000 of transactions.

- Fundscraper is licenced by and complies with strict governmental laws and regulations, in particular those of the Ontario Securities Commission and the Financial Services Regulatory Authority of Ontario.

- Our systems and people will help you determine your status as an investor qualified to participate in our select real estate investing opportunities under applicable securities laws and regulations.

- We are dedicated to building a long term relationship with all our clients and helping you to achieve your real estate investing goals through a diversified portfolio with real estate at the forefront.

- We are a community of real estate people standing by to welcome you to the neighbourhood.

- We standby at your direction to work with your trusted advisors and wealth managers.

Start Investing in Real Estate Backed Investments Today

Explore the investments available on Fundscraper.