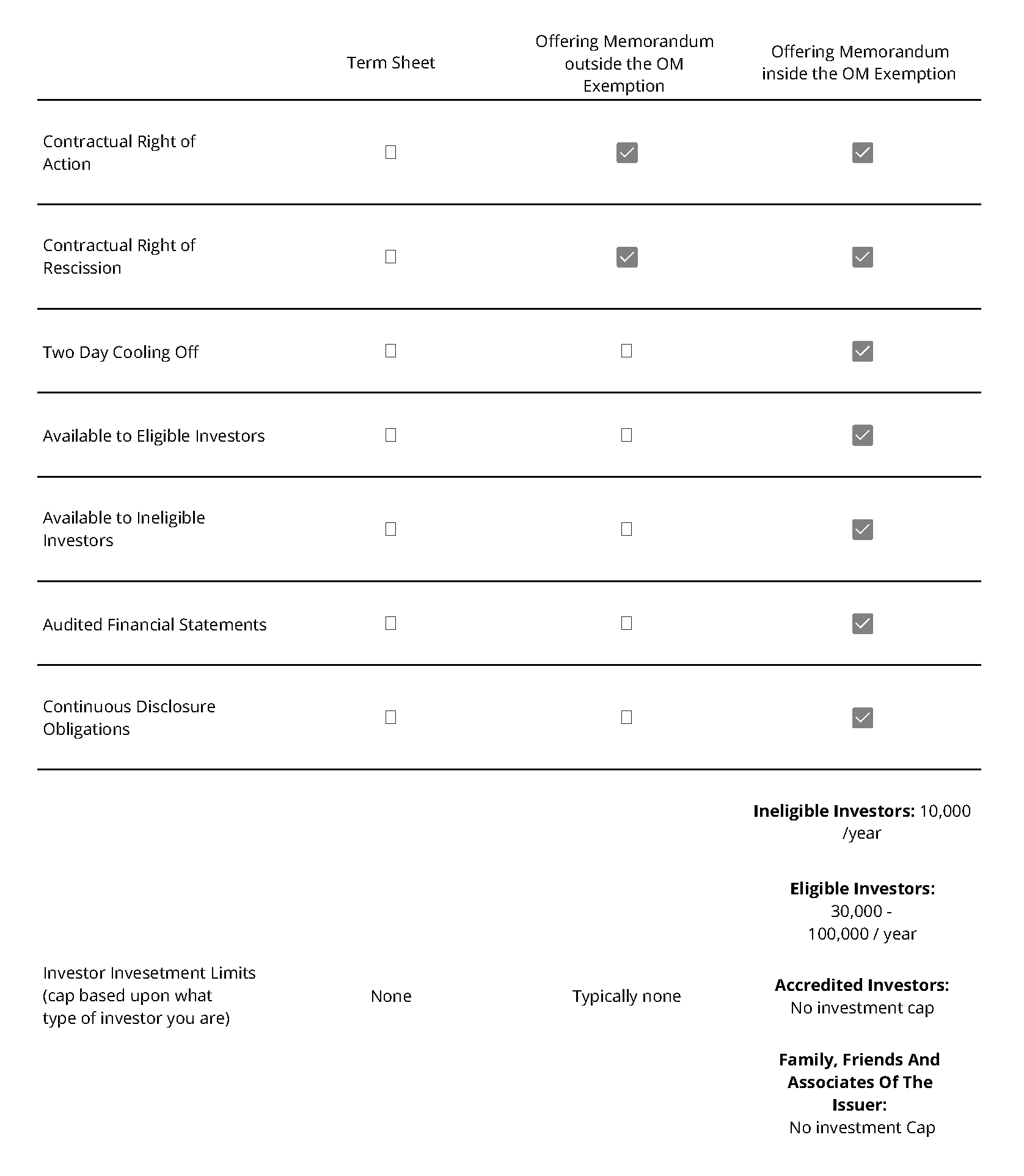

Before we define accredited investors, it is important for you to understand what the exempt market is. The exempt market is where securities are sold (under prospectus exemptions) without the protections that come with a prospectus. A prospectus is a document that outlines info about a security and the company or issuer that is offering it.

There are a number of prospectus exemptions and each one has its own rules as to who can sell and buy securities under these exemptions. One of these exemptions is the Accredited Investor Exemption. As an accredited investor, one gains access to a wide network of private investment opportunities with significant upside potential. So how do you determine if you are an Accredited Investor or eligible to invest in the exempt market under the other exemptions?

The Ontario Securities Commissions or the National Instrument or NI 45 106 set the descriptions of an accredited investor in Ontario and other provincial securities commissions throughout Canada. These rules created advantages to investing in large-scale investments which are the driving forces of Canada’s future economic growth. To help you, we’ve outlined the qualifications for the individual Accredited Investor below. You may qualify as an accredited investor in Canada if you meet at least ONE of the criteria below:

Income

- Your net income before taxes exceeded $200,000 in both of the last two years and you expect to maintain at least the same level of income this year; OR

- Your net income before taxes, combined with that of a spouse, exceeded $300,000 in both of the last two years and you expect to maintain at least the same level income this year;

Financial Assets

- You alone or together with a spouse, own financial assets worth more than $1 million before taxes but net of related liabilities.

Cash, or certain investments such as public equity or bonds, would be considered liquid/financial assets.

Net Assets

- You, who alone or together with a spouse, have net assets of at least $5,000,000;

This criteria requires that an individual have net assets that count for at least $5 million, with liabilities subtracted. This means that an investor with $4.5 million in real estate and $500,000 in cash may be considered an accredited investor.

Investment Opportunities for Accredited and Non-Accredited Investors

Exempt market securities offer investors more choice of products to help them achieve their financial goals, but they should be aware that there are many risks associated with investing in the exempt market.

Real Estate Investment Corporations

A real estate investment trust (REIT) is a company that owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, including office and apartment buildings, warehouses, hospitals, shopping centers, hotels and commercial forests. Some REITs engage in financing real estate.To learn more about Private REITs click here.

Mortgage Investment Corporations

Mortgage investment corporations or MICs allow investors to pool their money and provide loans to individuals and companies that were turned down by conventional institutions including banks, credit unions, and big lending companies usually at a slightly higher rate with varying loan periods. At least 50% of its assets should be in physical real estate, most of which include high-yield, residential mortgages.

One of the most appealing elements of participating in a MIC includes the typically stable and robust dividend rate that they provide to their shareholders while providing participating shareholders with mitigated risk through diversification. To learn more about MICs click here.

Investing with Fundscraper

As Canada’s leading private real estate investment marketplace, Fundscraper has customized investments to potentially match your desired income and investment targets.

Our goal is to help everyday investors access a world of new wealth that has historically been available to only a small portion of the population. Our easy-to-access online platform allows you to start investing in real estate backed securities with as little as $5000.

Our team has helped process more than $475M (as of June 30, 2022) in investor capital into high value real estate-secured investments. Join today. It’s time to get your money working for you to produce real results and enjoy the benefits of investing in real estate.